Airbnb Biz Model Canvas

Airbnb is creating value by initiating and managing transactions between guests and hosts of short-term property rentals. They make money by charging a transaction fee (=commission) on each transaction. A majority of stays are in the leisure market with business travel remaining a major growth opportunity.

Like Uber and WeWork, Airbnb was founded around the time of the GFC (or Great Recession). The founders rented out an air mattress in their living room - a cheap alternative for guests who needed to save money staying in San Francisco as an additional income source for the hosts to help pay their rent in one of the most expensive cities in the US. The early-day motivations still are some of Airbnb’s most pertinent value propositions for their users.

In the last 14 years, Airbnb has grown to an ample competitor for even the largest hotels chains and online travel agencies:

6m active listings (it was over 7m before the pandemic)

Listings in 100k+ cities in 220+ countries

4m+ hosts

$150b+ generated for hosts in over 1b guest arrivals all time (and $13.8k earned by typical US host in 2021)

The most relevant changes since our last update are related to the pandemic. It was a major stress test for Airbnb's business model and we will elaborate throughout this article including their financial results that allow some interesting conclusions to this end.

We recommend you also read the companion article on Uber's Business Model.

You will also get:

Value Propositions

As a platform business model, Airbnb needs to ensure to provide compelling value propositions to both sides (=participant types) of the multi-sided platform.

The key sides of their platform for Airbnb are guests and hosts. As in most cases with platform business models, value is provided/exchanged between the sides of the platform via indirect network effects. Broadly speaking, we distinguish between value propositions for (1) guests, (2) hosts and (3) both. The latter affects those moments where guests and hosts transact with each other.

Airbnb’s offers guests unique stays and experiences at low(er) prices (than hotels).

The value proposition to hosts are income generation, simplicity and safety (the latter addressing the biggest concern). Experience hosts can offer online and real-world experience to guests.

Value proposition for guests

Choice & variety

Cheap(er)

Authenticity / community

Value proposition for hosts

Income generation

Convenient transactions

Risk minimisation

Value proposition for guests

The amount of choice & variety: Airbnb has an unmatched amount of variety simply based on the fact that each home is different (exterior, interior and amenities). Hotels on the other side, need to have some sort of commonality to achieve economies of scale and apply repeatable processes. Somewhere in the middle are boutique hotels with different interior design in each room but it’s not the norm.

Often cheaper than comparable sized hotel rooms: We will see a comparison later, but often Airbnb homes are cheaper or provide more value (cost vs what you get). Included amenities (e.g. kitchen, coffee machine, washing machine, etc) can save cost on ancillary items, such as breakfast, meals and more.

Authentic stays & experiences: one of the earliest and still present propositions is to experience the location more authentically. This can start with the fact that guests and hosts meet each other but goes far deeper. Compare this to the other extreme of resort holidays where people may not experience anything authentically.

Value propositions for hosts

Income generation: There are different cases. Some hosts list one of their rooms on an occasional basis that they would never sub-lease on a long term basis (extra income at some inconvenience). Others lease their property that they don’t use themselves because they can achieve higher income than through long-term rentals (though occupancy rates, involved workload, etc also play a role). Generating income is a key motivator to list one's property.

Risk minimisation: The big one for hosts are all the risks to their property, their interiors and potentially themselves (the latter applies to hosts as well) and potential risks to the guests on their premises. Airbnb offers solutions/mitigators to many of the concerns & risks.This includes things like Insurance (though not everything is covered); ability to set house rules that guests need to confirm adherence to prior to booking (e.g. no parties, no smoking, pets, etc) and various other measures.

Ease of joining the platform which includes making it as simple as possible with guidance through the process, resources, case studies, clarity around hosting requirements as well as support (live chat, email, phone). This doesn’t preclude safety checks, etc.

Management tools for hosts basically a mini reservation management system with various feature, such as:

Listing details, photos, amenities, etc;

Price setting;

Availability calendar;

And more

Key Partners

We distinguish between key partners, those that are crucial to the platform, and other partners. Airbnb’s crucial partners are the hosts, including superhosts. The hosts are on the supply side and help to deliver the value proposition to the demand side (guests).

Hosts bring their properties and/or services to the table. Achieving a critical mass of supply and variety of choice is important for the customer value proposition. But hosts can multi-home on one (or more) of the competing platforms.

Tourism partners and communities: It is part of the playbook for travel companies to partner with the many tourism bodies and communities around. But where most travel companies focus their main efforts on collaborating with tourism bodies to stimulate demand (often through marketing collaborations), Airbnb seems to be focussing more on partnering with communities and under-represented groups. Though I can’t refer to any study as such, looking at Airbnb’s community newsroom will give a clear indication.

Airbnb is partnering with many other technology firms on the non-competitive advantage parts of their technology. Some tech partners are:

A long list of preferred/additional software partners. Many of them are technology providers in the travel industry. They are used to get hotel inventory (listing) into Airbnb (non-Airbnb homes), managing bookings (e.g. availability, pricing) and other typical travel inventory tasks.

These are not exclusive to Airbnb. The same platforms are used by other online travel agencies (e.g. Booking.com) for the same purposes.

Airbnb called out when they started collaborating with SiteMinder to connect to boutique hotels, etc. This platform is also used by 280 OTAs and a total of over 400 integration partners.

Maps, payment platforms, cloud storage, identification and many other technologies are important but they are not a distinctive advantage that is hard to replicate.

Other: There are other partners, such as corporate travel partners, associates, commercial partners and more. See the note below on this.

Key Activities

Having achieved considerable scale, there are three types of key activities for Airbnb: (a) operational excellence (i.e., consistency); (b) continued expansion of the host/guest base (i.e. innovation adoption trajectory); and (c) improve existing value propositions and develop entirely new ones.

From a platform business model perspective, most of these activities can also be categorised into reductions of search, transaction / post-transaction costs as well as enhancing positive network effects while reducing negative ones.

Achieve/retain consistency: Hotels can deliver consistency because most of the factors contributing to it are under their control. With Airbnb connecting two strangers, that is not the case. Host don’t receive training and (at least initially) have little experience doing so. As Airbnb grows their user base, they need to make sure that their hosts deliver good value for the price they charge. They have several layers of requirements and tips.

The network effects are often stated as the competitive advantage of platform businesses. Growing the platform’s user base is an important way to further enhance network effects and value proposition.

Grow network effects: The more hosts join, the more inventory and choice there is for guests to choose from. This is equally true for stays and experiences. Destination-based experiences form a valuable complementary offering. But to enhance network effects, the guest side needs to be grown commensurately. Further, Airbnb will require critical mass in sought-after locations.

And then there are activities around improving existing value propositions and developing new ones. Some examples are:

Airbnb added new offering tiers with Airbnb Plus and Luxe.

When covid struck, Airbnb built and launched Online Experiences within an incredible 14 days. The feedback seems so positive that it will likely outlast the covid period (though it is difficult to see network effects to the core).

They are working with large property developers and owners to be able to add multi-home complexes to their inventory, so far with little success.

In addition, there are the hundreds of ongoing projects and improvements.

Our Flagship Course

Key Assets & Resources

The most important asset of the platform business model are its network effects. It is the resource/asset that needs to be built and nurtured. The data, the algorithms and the capability to analyse and gain insights are essential.

Positive network effects can be diminished by negative customer relationships and need to be maintained and improved as part of the key activities.

Network effects between the participants (hosts and guests) are essential. For network effects to occur a sufficiently large number of them need to be on the platform and of course sufficient velocity of transactions (the latter being worth a call out due to the fact of the less frequent nature of these transactions):

6m listings worldwide in 100k+ cities across 220+ countries

400k superhosts

2m+ stays per night

50k+ experiences in 1k+ cities

Data assets: Captured user data and other data (external).

Algorithms, technologies, analytic capabilities and more (more shortly).

Skilled engineering & other staff, including local staff.

Brand: Airbnb’s brand is crucial and what they stand for. You may see Booking.com, Expedia and TripAdvisor as somewhat interchangeable. But Airbnb is unique and recognisable. All work that has gone into building the brand has been geared toward not being seen as an intermediary but the actual provider of the customer experience.

And more

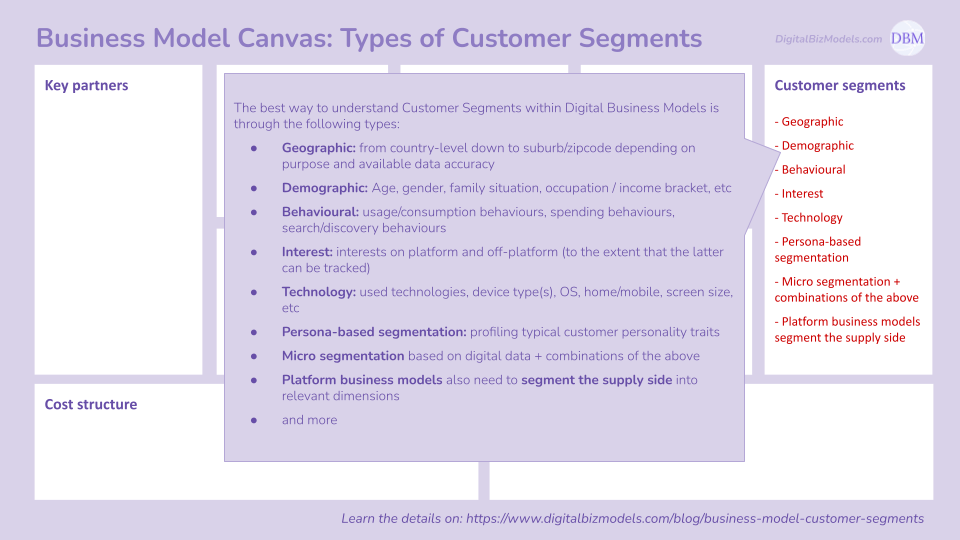

Customer Segments

As a multi-sided platform business, Airbnb needs to segment both sides: the guests as well as the hosts. Depending on the purpose, Airbnb likely uses classic market segmentation as well as micro segmentation. Identified segments can be used for a variety of purposes, including marketing, developing new products and important business growth decisions and more.

Potential ways to segment guests:

By geo-demographic

Behavioural

Trip type: Business travel; leisure travel; visiting friends/family; backpacking.

Rental type: Shared space; private room; entire home/apartment.

Accompanying guests: Number & type (spouse, kids, parents, etc).

Motivation-based: primary reasons for using Airbnb (more shortly).

Interest: Types of activities that travellers engage in (esp leisure), particularly interesting for Airbnb Experiences / Online Experiences.

Potential ways to segment hosts:

Geo-demographic: see above.

By rental type and type of accommodation provided:

Private room, entire place; room, unit/condo, house, unique stays.

Tier: Plus, Luxe, for Work.

By location type and characteristics: Urban, suburban, rural, exact location, proximity to amenities, etc.

By motivation to host: Maximisers, opportunity seekers.

By the types of experiences provided: food, craft, nature, activity, etc.

This survey by the Pew Research Center shows three prevailing demographic factors are (dark red): educational attainment (college grad+); income (>$75k); age bracket (30-45) correlate particularly high with Airbnb market penetration. There are some overlaps with Uber and also quite a few differences as you can see.

What’s new in Airbnb’s Business Model (August 2023)

There were very insightful updates to Airbnb’s biz model in August 2023.:

Jump to the video version here

And/or check out our article on the latest on Airbnb’s biz model

Channels

Marketing & Sales channels include:

Word of mouth one of the strongest drivers that can help alleviate concerns users may have before the first usage.

Free and ongoing media coverage.

Social media: Their social media channels and the organic shares among users

Digital ad campaigns through Google Ads and social media. Currently, their biggest marketing campaigns are the Olympics and Paralympics (now next year).

Referrals get rewarded.

It is quite remarkable that Airbnb does not use travel agencies as sales channels. As mentioned under key partners, they do get 3rd party inventory (boutique/small hotels) into their platform through tech interfaces.

Most firms in the tourism industry try to maximise sales by using all available channels. Airbnb des the opposite and tries to minimise intermediaries and build direct relationships with their customers. Corporate travel is the only (partial) exception to this.

Transaction channels:

App: Most transactions can be managed through the app, including planning, booking, payment, etc.

Hosts can manage things through the site / App.

Communication between host and guest through the App or other means.

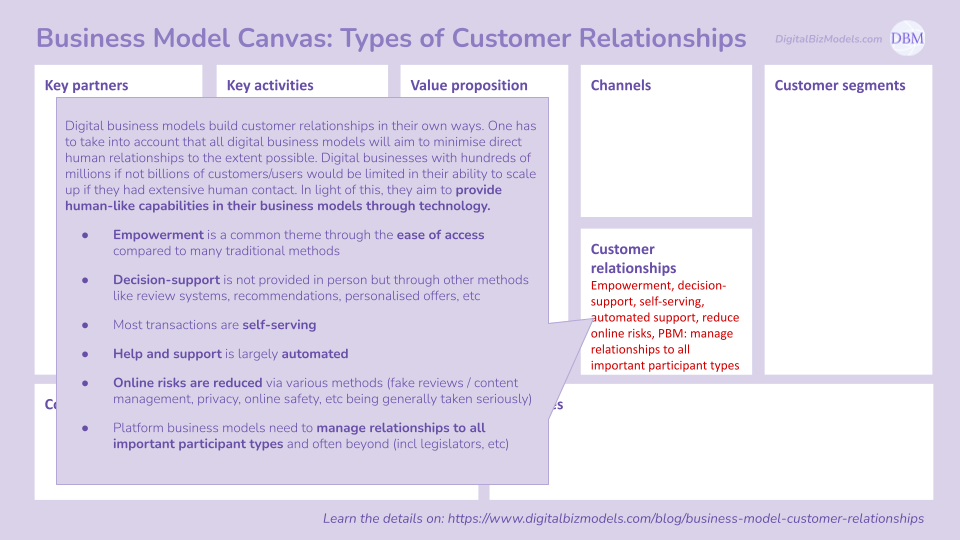

Customer Relationships

There are important layers of relationships that Airbnb needs to foster. Some of the most important include their relationships to (1) hosts and guests; (2) cities / communities and the broader stakeholder environment around them; and (3) wider externalities.

Airbnb has managed to avoid major fallouts unlike Uber but they too are facing a lot of resistance in many regions.

(1) Hosts and guests

I do think it’s fair to say that Airbnb is doing more than most, if not basically all, other major platforms in managing their relationships to guests and hosts as well as the relationships among these two crucial groups.

Important topics that Airbnb will need to get right for hosts and guests to feel good about their “relationship” to Airbnb:

Safety, Security of both parties.

Holding their value proposition on hosting and consistency in doing so.

Supporting the authenticity of the stay.

Respect for the host’s property and adherence to house rules (in particular rules around parties, pets, smoking).

And more

(2) Cities / communities / legislator / regulators

We need to look beyond the direct customer to understand the impact of platform business models. These business models are an emerging phenomenon with considerations and issues to be resolved. Some examples are:

Neighbours can report parties and other issues of concern. Being able to solve these kinds of issues in a reliable way would help Airbnb considerably. Airbnb has banned all parties after a shooting indefinitely.

Communities (read: non-hosts) fear the impact of revolving short-term tenancy in their neighbourhood or next door on quality of life. Short-term tenants can behave differently in many ways than they do at their own home and neighbourhood. From this perspective, it is a valid concern. This can affect many aspects from noise to other nuisance.

Responsible hosting

While these rules have a lot of items, it is the restriction around days per year of short letting that has the biggest financial impact on Airbnb. Some cities have demanded for Airbnb to hand over host data so they can check whether hosts comply but Airbnb has taken legal action. Cities have argued that hosts don’t comply unless the city enforces the laws while Airbnb argued it would be a breach of privacy to hand over the data (which courts have accepted).

San Francisco has reached an agreement whereby Airbnb is not allowed to list homes that don’t comply with the rules. The effect was that 4,000 of the then 9,000 listings disappeared. Airbnb stated that a ~20% were added since. But we can see the impact.

The status differs by city and state - see the map above. Airbnb reached a settlement with NYC by which Airbnb needs to report rentals for those hosts that consent and delist those that don't consent. It will take effect around late 2020 or early 2021. This could have major impacts on Airbnb’s NYC market. The effects will be known after a while.

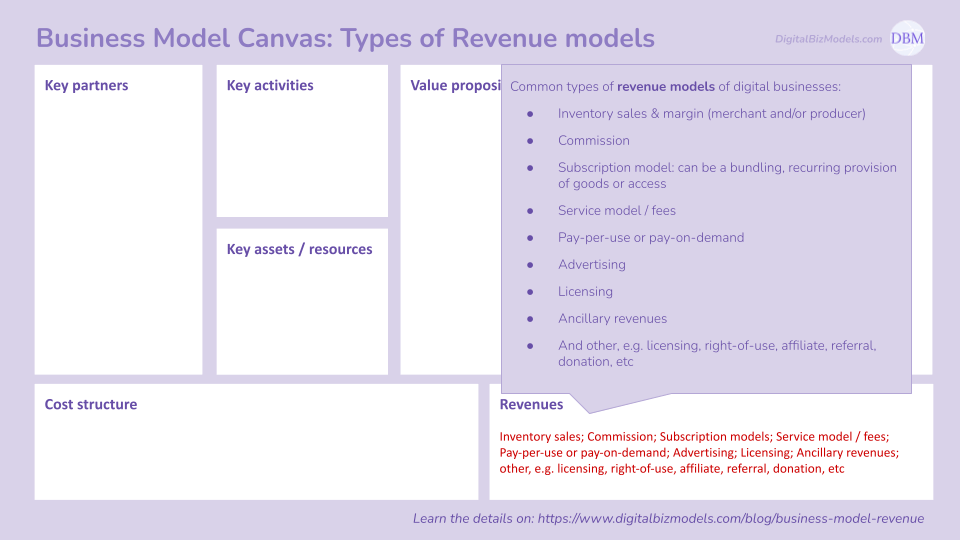

Revenue

Since their IPO (during the pandemic), we finally have publicly available data. Their revenue shrank by 30% in 2020 and rebounded by 77% in 2021. This is (remarkably) an increase of 25% compared to 2019 (granted the second half of 2019 was hard---hit by the pandemic.

Their statement of operations shows that they made an operational profit. It doesnt show the net profit/loss which in this case is a loss of $352m (or ~7%). This is still a relatively good result compared to many other peers and given it is within an industry that was very much affected by the pandemic.

Airbnb Premium Product

If you want to learn me about Airbnb, check out our Premium Product on them

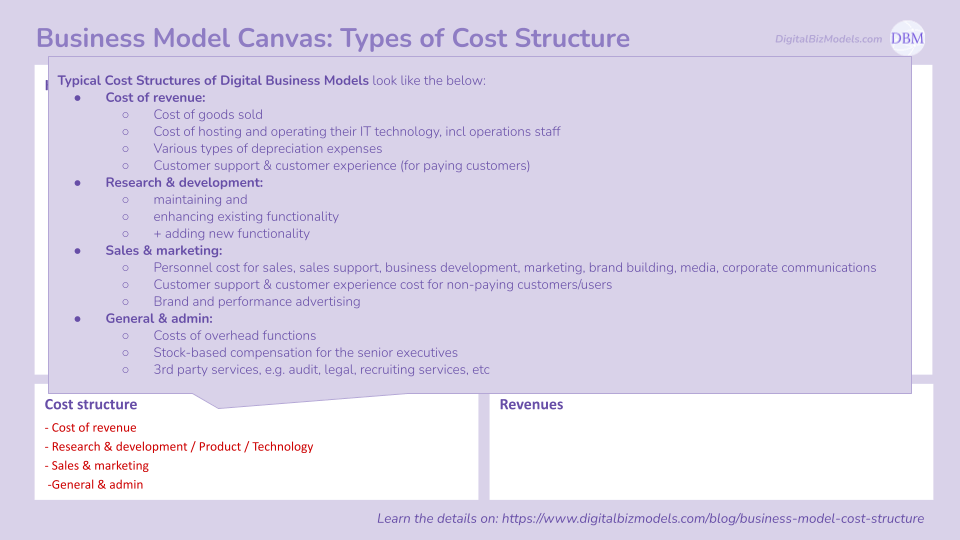

Cost Structure

In a nutshell, it looks like this:

Cost of revenue will include things like insurance premiums, payment fees, ongoing IT costs.

Sales and marketing: Advertising to acquire & retain customers (hosts & guests). It could include discounts, promotions, (covid and other) refunds, referral fees, etc.

Product development: engineering costs, product development, design, improvement of the platform and other R&D costs.

General & Admin: general management, execs, admin employees (e.g. HR, finance, etc) legal fees, professional services,

Restructuring charges: This includes transformation and the sad episode of retrenching people at the onset of the pandemic that you would have heard about

And other costs, including interest expense: these are not part of the operating profit/loss,, hence not shown here.

Yes, the ugly results in 2020 have all to do with the IPO and the stockbased-compensation expenses for the founders and early execs.