Best Fintech Biz Models: Fiserv - the Hidden Giant

In this our mini-series on the best Fintech Biz Models today we are covering the Hidden Giant of Fintech: Fiserv!

Had you invested $1,000 in Fiserv at their IPO, you could have collected $570,210 in July 2024. It must be the most remarkable growth of all Fintechs to-date.

With their fascinating set of financial and merchant solutions, it is no wonder they ranked first in the revered IDC’s Fintech index in 2023.

We are covering Fiserv as one of those unsung heroes in the financial services sector. They are not only larger by market cap than most Fintechs but also the biggest winner (in terms of gains) in the $50b+ market cap class. None of the other recent Fintechs has come even remotely close (with many below IPO pricing).

They are the typical “pick-and-shovel” provider behind the scenes who sometimes make the biggest gains of a gold rush (Fintech growth being the gold rush). Nvidia is the equivalent of the AI boom of the early 2020s.

What does Fiserv do?

Fiserv offers solutions to merchants, financial institutions and fintechs of all sizes

They own parts of payment networks through which they are connecting many firms & consumers

And they have many other B2B products & services for commercial businesses

In addition, they have been growing rapidly through the acquisition fascinating Fintechs

Fiserv biz model

To understand better what Fiserv does, let’s compare them to an indirect competitor that we know well: PayPal.

Fiserv vs PayPal differences & competition:

PayPal is largely an end-point payment provider, meaning their assets are at the remitting (customer) and receiving (merchant) endpoints. Fiserv provides digital banking technologies but does not have direct relationships with consumers.

Both monetise on payments. PayPal has 35m merchants and $1.5t TPV. Fiserv has 6m merchants and a $4.5t payment volume, i.e. on average their customers are larger.

Fiserv has a far broader set of offerings. This may be the reason why investors price in considerably more growth into their share price as of mid-2024 (P/E of 29 vs 16 for PayPal).

Value Proposition Example 1: PayTheory

Let’s look at one competitor of PayPal who has large parts of their technology built on Fiserv.

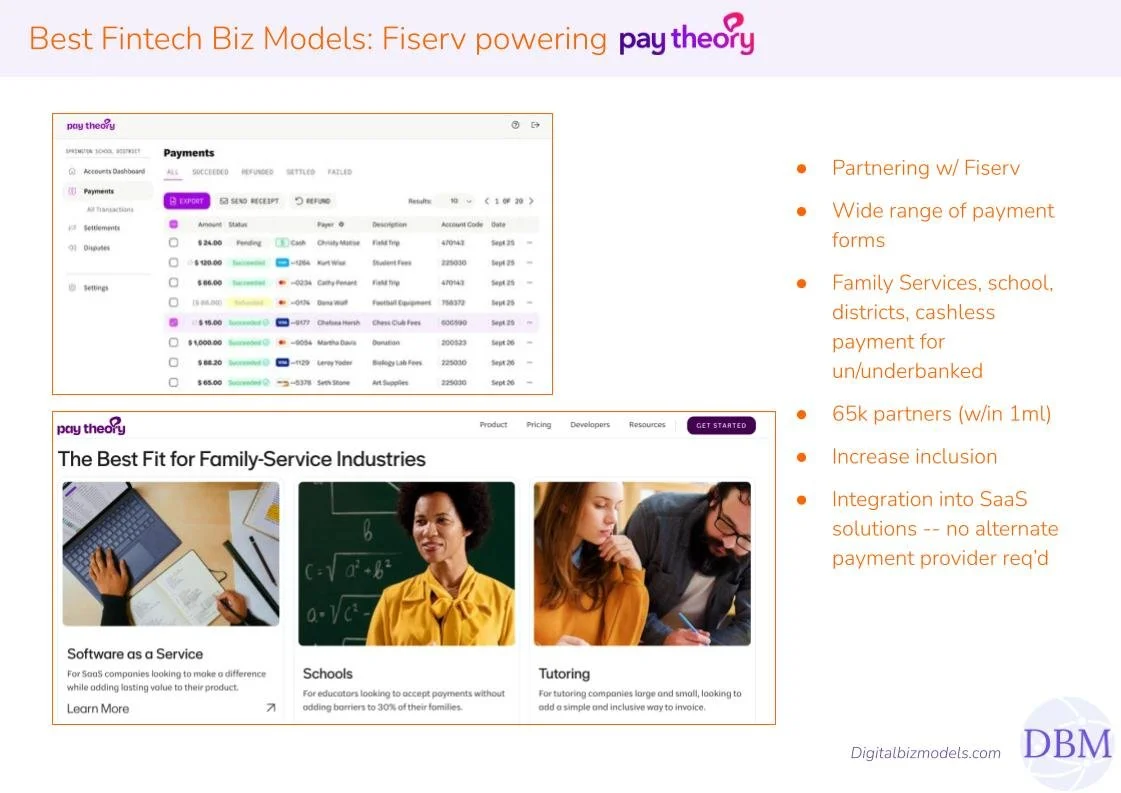

Pay Theory is a payment processor that allows many forms of payments (credit card, ACH, cash) utilising Fiserv technology to a great deal. Using Fiserv’s technology enables them to leverage a broad range of payments and financial service capabilities.

Using Fiserv’s extensive financial network and services, Pay Theory offers their customers (e.g. schools and school districts) to collect payments in various forms including in cash via a network of partners. Un/underbanked families can use one of 65,000 collection partners in the US (with one within an average distance of 1 mile each school) to pay school-related fees, e.g. tuition or school activities increasing inclusion and collection rates.

Value Proposition Example 2: Carat

Carat is centred around omnichannel payments and frictionless customer experiences (which translates to more completed transactions).

One of Carat’s key value propositions is enabling “all” payment methods, channels, devices and partners on a global scale and utilising Fiserv's extensive payment network. Apart from the usual payment methods, this also includes:

Digital wallets with branded currency (i.e. branded loyalty points, like frequent flyer points) being used for payments from within the business customer’s app. Such currencies are very popular and create a captive audience.

The Best Fintech Biz Models Today

Fiserv’s Business Model has a lot more fascinating aspects than we are covering in this article. But you can find them in our Fintech along with more…

Learn not only more about Fiserv but also 5 other innovative Fintechs:

Robinhood ~ Coinbase ~ PayPal ~ Fiserv ~ CoreLogic ~ Xero

We have carefully selected super-instructive examples from different sub-verticals of Fintech that elaborate on a broad range of creative business model approaches.

~50 pages (pdf) presented in a wonderful format that is easy to read & understand.

You will love reading this book!