What is a Digital Business Model? (summary of our 7-part series)

In our 7 articles on the fundamentals of digital business models, we have provided you with some 50+ pages of knowledge.

This article is a summary of the series with additional insights spanning across the entire series.

What a digital business model is not?

We have to start with what a (digital) business model is NOT. That is because a large majority of online resources focus on the wrong thing. There is a big mix-up of business models with revenue models.

Some of the most commonly-mentioned “business” models are the subscription model, freemium model, ad-supported models and more. These are revenue models. It’s valuable to know about them but not a good idea to call them a business model.

Let’s just take one example that shows why confusing the two would be misleading.

Take the two biggest subscription (revenue) models: Netflix (~$35b revenue) and MS-Office (~$50b revenue).

If the subscription model was a business model, these companies would run the same business model (as would Amazon Prime delivery, Adobe Photoshop, Robinhood Gold and Apple News+).

We could list hundreds or thousands more examples that all monetise on the subscription model without having much similarity in their business models.

We all know they are not based on the same business model!

Put it the other way: if we learn a lot about MS-Office, we will not have learned a lot about Netflix even though they both monetise on subscriptions.

So, what is a digital business model?

However, if we categorise MS-Office based on value creation as a Software-as-a-Service company, then we can transfer a lot of what we learned to thousands of other SaaS businesses!

SaaS businesses have a lot of business model elements in common with each other and much less so with Netflix (or content & media businesses for that matter).

⇒ The idea behind this is to simply categorise business models based on value creation, not by value capture (=monetisation / revenue model).

The guys from the MSCI & S&P Dow Jones had the same idea for traditional businesses and came up with the GICS (Global Industry Classification System) used by millions of investors and analysts.

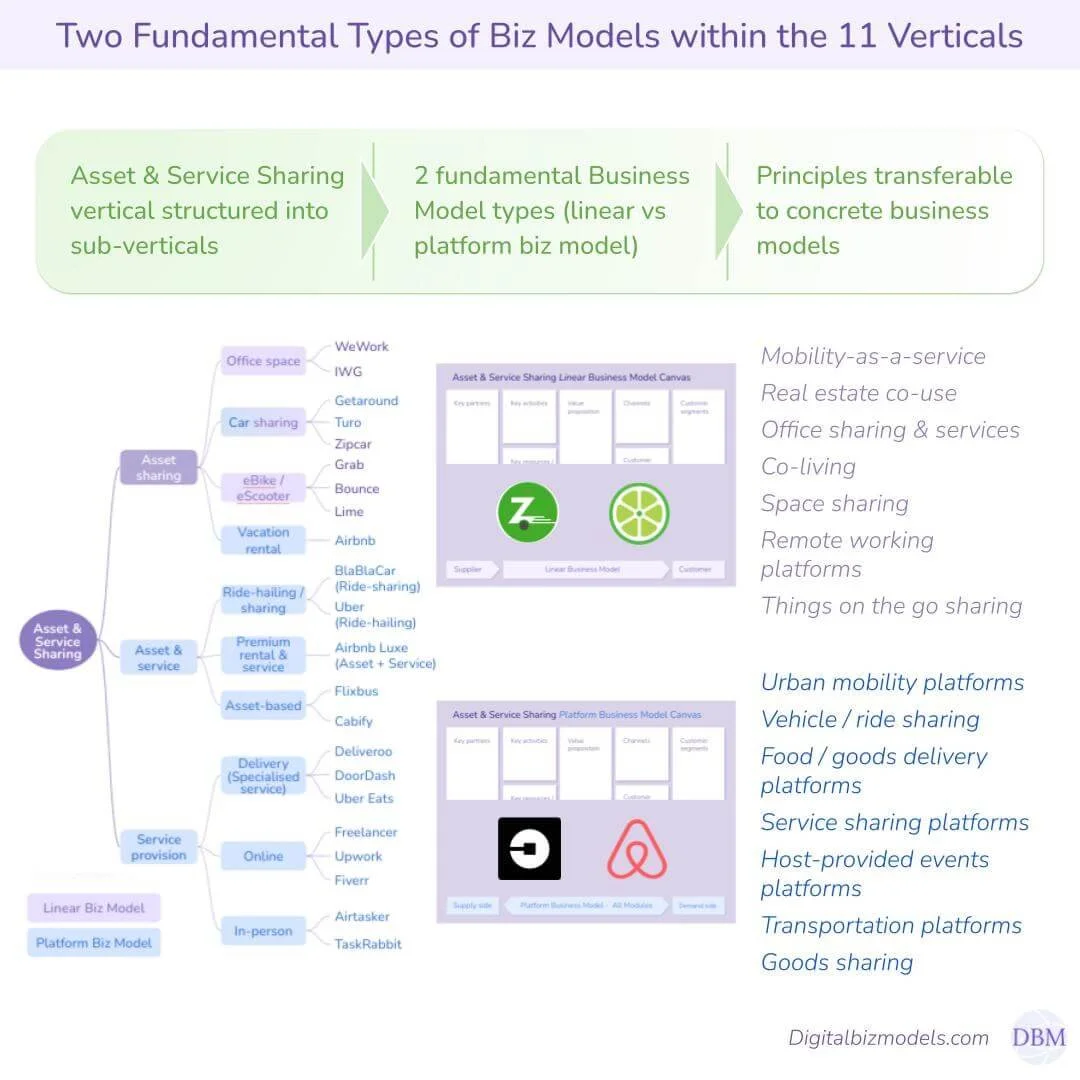

Doing the same for digital business models leads us to 11 verticals.

Key insight: Categorising business models based on value creation leads to more homogeneous groups than categorising them based on revenue models.

Benefits of categorising business models by Value Creation

Asset and Service Sharing is an intriguing vertical that includes companies like Uber, Airbnb, Lime (eBikes), DoorDash (meal delivery), Getaround (car sharing), TaskRabbit (home services), Fiverr (professional services) and thousands more.

These Digital companies are creating value by providing their customers with access to a shared asset and/or service.

All of them create value through a combination of a service and an asset component. However, the contribution of these components in value creation can vary a lot.

A meaningful way of subcategorising this vertical is the main value creation driver: the asset, the service or both to a roughly equal degree.

So, we have quite a variety of businesses in this vertical. And of course, there are differences among these business models.

However, they have many business model aspects in common, in particular within their value creation activities. This includes all the ones here:

Attract supply side participants to their business

Verify supply side participants, conduct background checks where applicable, onboard them and get them started,

Ensure a truthful description of their services and assets

Categorise services, present them appealingly, make them browsable and searchable for the demand side

Match the most-suited supply side participants with the demand side searches

Manage the transactions, including payment, timely and safe service delivery, ratings and more

These value creating activities are among the core of these firms. Yet, we can say that all companies in this vertical have them as part of the business model. This is pretty significant.

Key insight: Businesses within the same vertical create value in similar ways. Learning about a representative set of examples within a vertical, we can transfer knowledge to thousands of other companies within the same vertical (and to some extent even to other verticals).

Fundamental Concepts in Value Creation

Each vertical is characterised by similar sets of customer value propositions. With this, they have a range of similar value creating activities.

However, the approach to creating value within the same vertical can significantly differ.

At the most fundamental level, we distinguish between two fundamentally different types of business models:

The Linear Business Model

The Platform Business Model

Linear business models create value by sourcing inputs from suppliers and creating something of higher value for their customers than the sum of the individual parts. There are dozens of different sourcing, design and manufacturing models.

Platform business models have a so-called supply side strongly involved in value creation and value delivery to the platform’s customers. In the linear business model, the supplier is considerably detached from the customer.

Prominent examples of linear business models are:

Amazon eCommerce

Microsoft Office

Netflix

Mega caps using the platform business model are:

Google Search

Apple’s ecosystem of apps

Uber

Apple is an interesting example in that they use the linear business model for the design and manufacturing of their iPhone hardware and the platform business model for the 3rd party ecosystem.

And looking into Apple’s own apps, we can distinguish:

Apple News+: platform business model

Apple Arcade: platform business model

Apple Fitness: linear business model

We can distinguish between these two types of business models in almost all 11 verticals.

Example of knowledge transfer

For example, by focusing on value creation via a platform business model in asset & service sharing, we can gain insights on business models in:

Urban mobility platforms

Vehicle / ride sharing

Food / goods delivery platforms

Service sharing platforms

Host-provided events platforms

Transportation platforms

Goods sharing

Equally, if we analyse the typical elements of linear business models in the same vertical, we already know the basics of:

Mobility-as-a-service

Real estate co-use

Office sharing & services

Co-living

Space sharing

Remote working platforms

Things on the go sharing

It’s a great starting point from which we can analyse and design similar business models.

Success-defining concepts

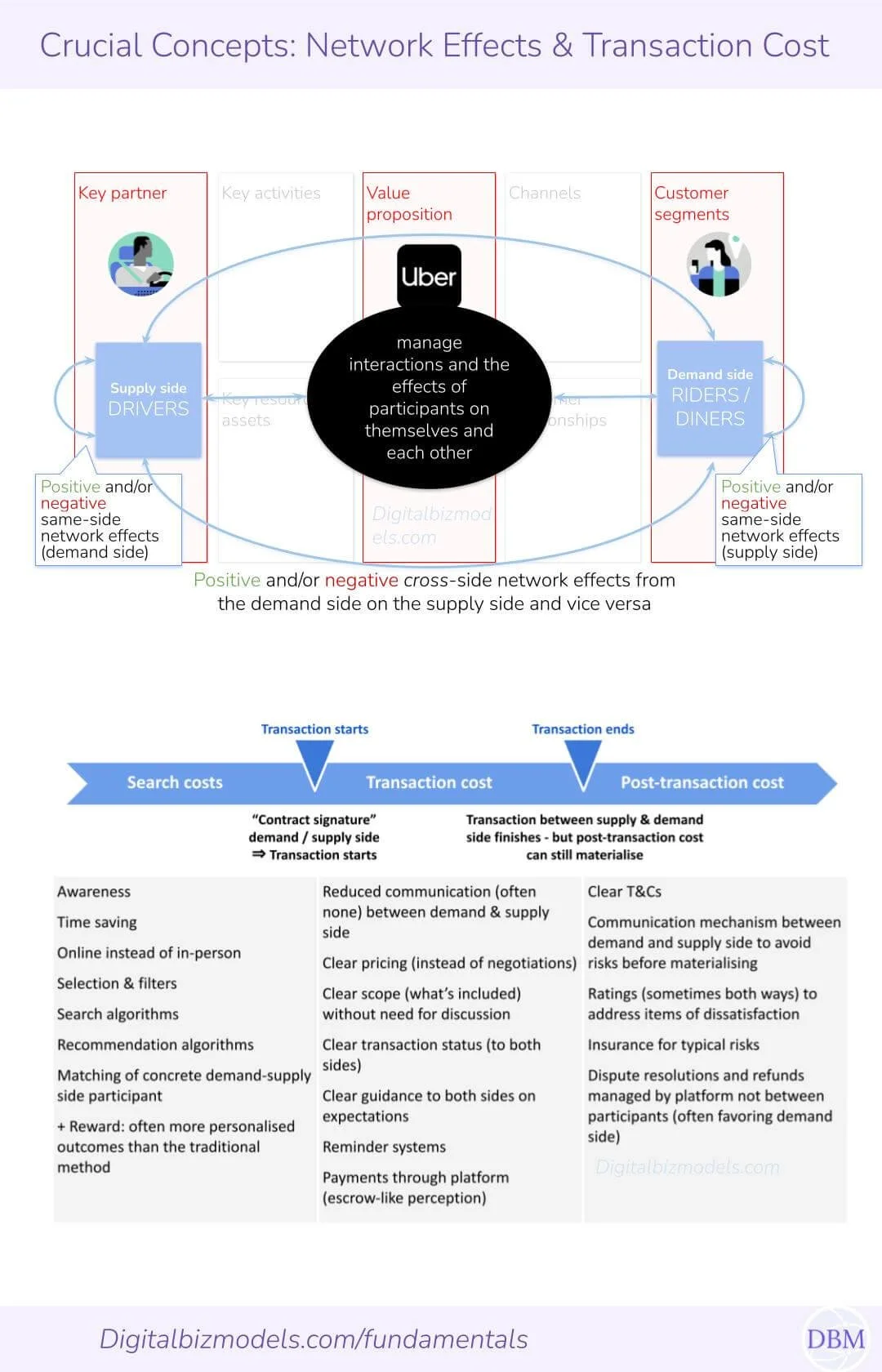

The concept underpinning platform business models are so-called indirect network effects.

Network effects

There are many different types of network effects with indirect network effects being the most relevant one in our context.

Indirect network effects create incremental value between the supply and demand side as more participants join and use the platform.

Take Uber: The more drivers join Uber, the more cars are available in a given area. This gives the demand side (customer) shorter pickup times and lower fares. Conversely, more customers using the platform lead to more income for drivers via less idle times, a virtuous loop.

Many startups and analysts look at this concept in isolation and say that once sufficient network effects are achieved, the platform will take off.

But we have to look at this in conjunction with the next crucial concept.

Search / Transaction / Post-transaction costs

These “costs” refer to any burden involved in using the platform. Some also call this “friction” but this term is not comprehensive enough.

Search / Transaction / Post-transaction costs can include an individual's financial costs, time, efforts, skills, knowledge, risk / decision aversion and many other factors.

Take a look at the image for more details on both of these concepts.

We have seen how these two effects can interplay and decide the fate of a digital business. Comparing Getaround (a car sharing company) to Uber (ride-hailing), we see a 3,000,000% difference in market cap with the key reasons being rooted in the business model design and explainable by these two success-defining concepts.

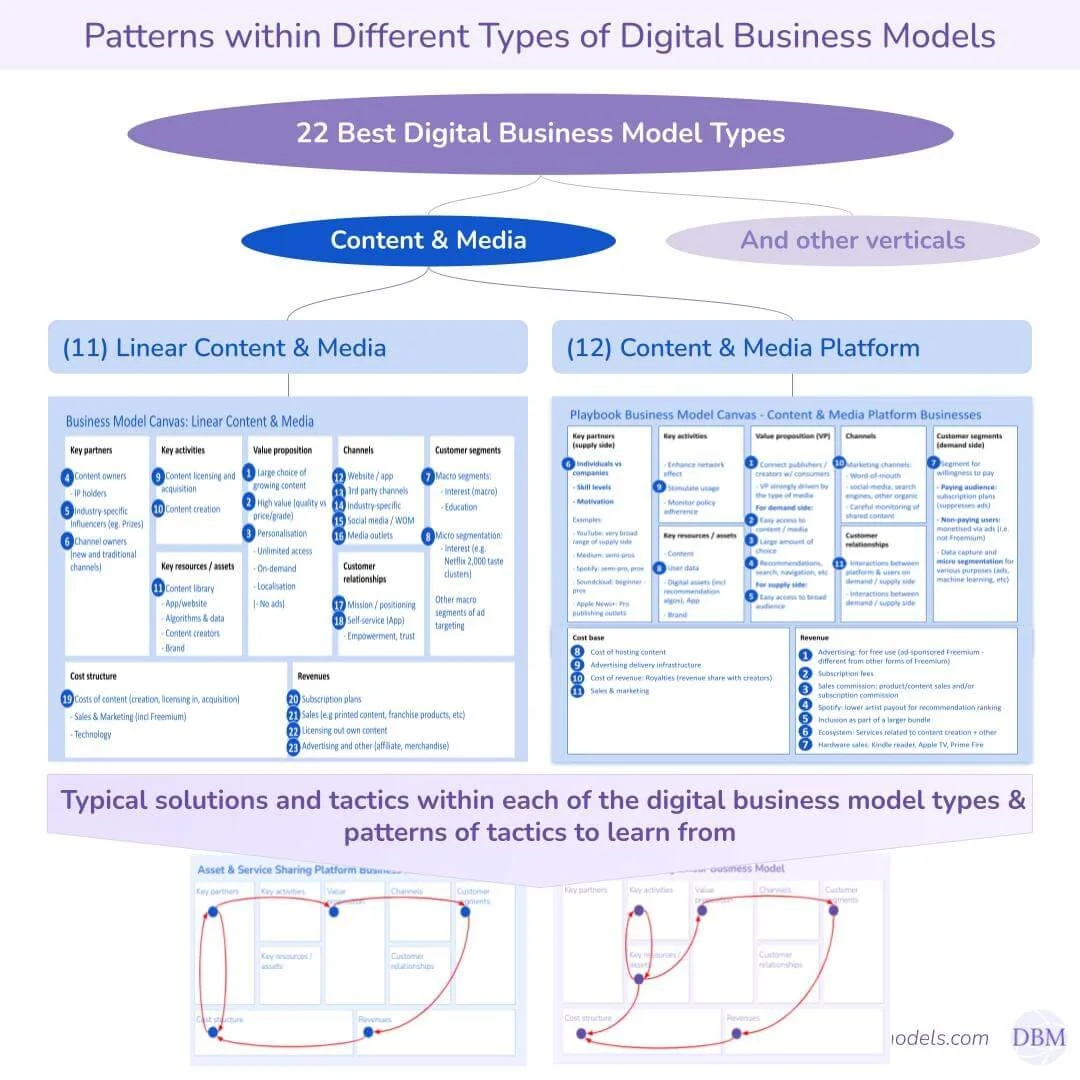

Types of Digital Business Models: Gaining Breadth

We have seen that categorising digital business models by value creation leads to 11 digital verticals. And we have just seen that there can be considerable differences in the outcomes within a vertical.

An interesting question is which approaches have brought the best results within each vertical. In the next step, we are looking at subvertical level. We can subdivide each vertical further and doing so leads to 3-10 subverticals in each which makes it 100+ subverticals.

We decided to look at the 2 most successful approaches within each of the 11 verticals (in terms of the number and market cap of protagonists that have emerged). This leads to the 22 best types of digital business models today (this can change in a few years down the track).

The image shows how it looks.

Within each of these subverticals, we can find typical tactics of how successful companies have designed the business model elements.

Understanding these common tactics by vertical can fast-track our learning.

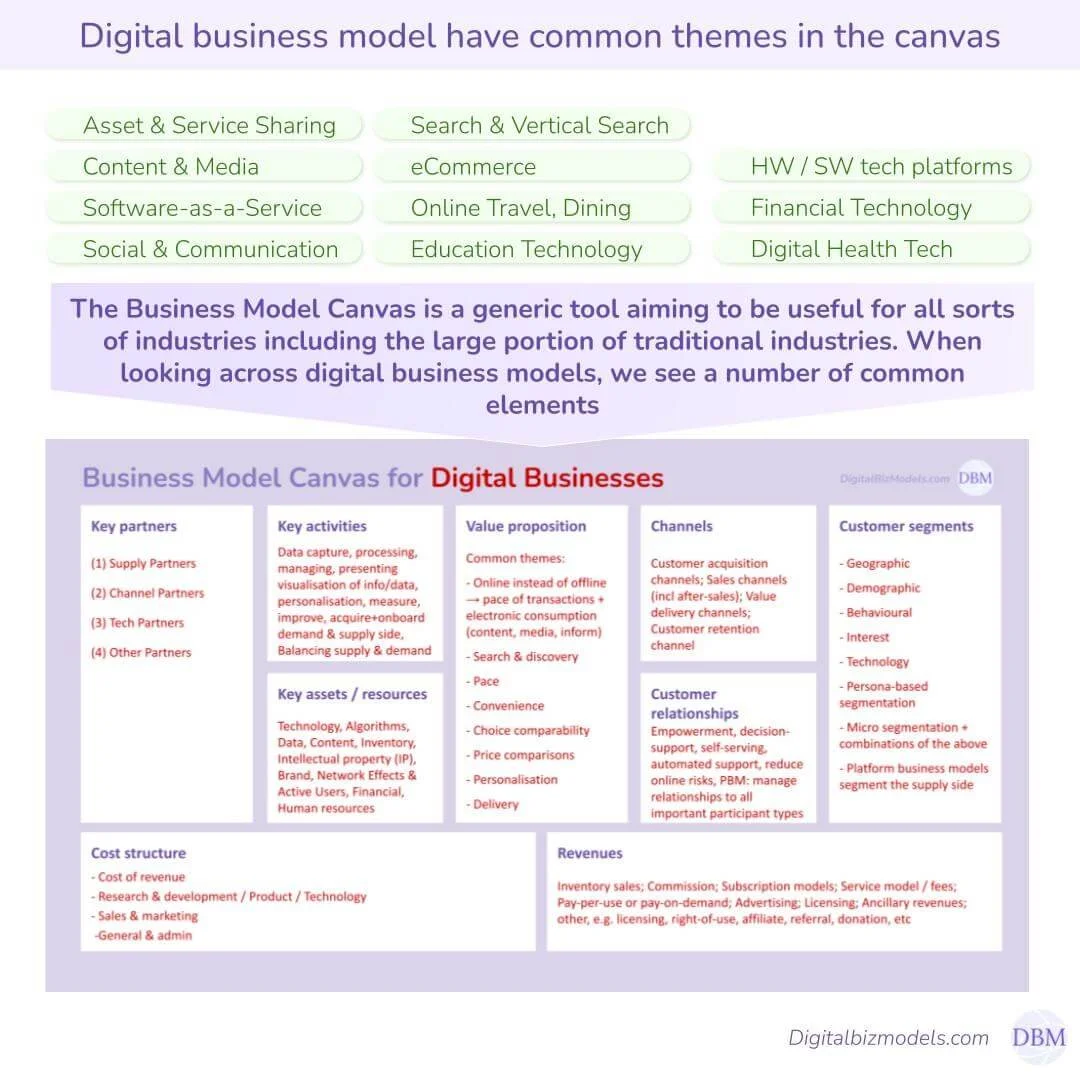

Business Model Elements

One of the most common tools used to describe business models at a high level is the Business Model Canvas (often only called canvas). It consists of 9 elements.

The canvas was developed in 2005 with all industries in mind. The vast majority were traditional industries. In our article series on the business model canvas for digital business models, we covered the elements of the canvas from the perspective of digital technology.

As per the canvas, we have elaborated the individual elements:

Key partners: Supply Partners; Channel Partners; Tech Partners and Other Partners

Key Assets & Resources: Technology, Algorithms, Data, Content, Inventory, Intellectual Property Brand, Network Effects & Active Users, Financial, Human resources

Key activities include data capture, processing, managing, presenting visualisation; personalisation, measure & improve, acquire+onboard demand & supply side, Balancing supply & demand

Value Propositions: Online instead of offline; Search & discovery; Pace; Convenience; Choice; Price comparisons; Personalisation; Delivery

Channels include Customer acquisition channels; Sales channels (incl after-sales); Value delivery channels; Customer retention channel

Underlying Customer Relationship principles include: Empowerment, decision support, self-serving, automated, support, reduce online risks, PBM: manage relationships to all important participant types

Customer segments: Geographic; Demographic; Behavioural; Interest; Technology; Persona-based segmentation; Micro segmentation; PBMs: supply side segments

Cost structure: Cost of revenue; Research & development / Product / Technology; Sales & Marketing; General & Admin

Revenues: Inventory sales; Commission; Subscription models; Service model / fees; Pay-per-use or pay-on-demand; Advertising; Licensing; Ancillary revenues; other, e.g. licensing, right-of-use, affiliate, referral, donation, and dozens more

Each of these articles offers more detail than we can show here with a significant amount of further details taught in our flagship course.

Vertical-specific Business Model Canvasses

We just looked at the business model canvas from an aggregate digital technology perspective. We can also go the next level down.

The combination of verticals with the elements of the business model canvas leads to very powerful insights. We can see that there are typical patterns in each of the subverticals and fundamental types of business models.

In addition, there are also patterns of value creation and value capture (monetisation) that work better than others. Learning about these tactics and patterns allows us to transfer knowledge or build conscious hypotheses about how we can diverge from existing ideas (break the rules).

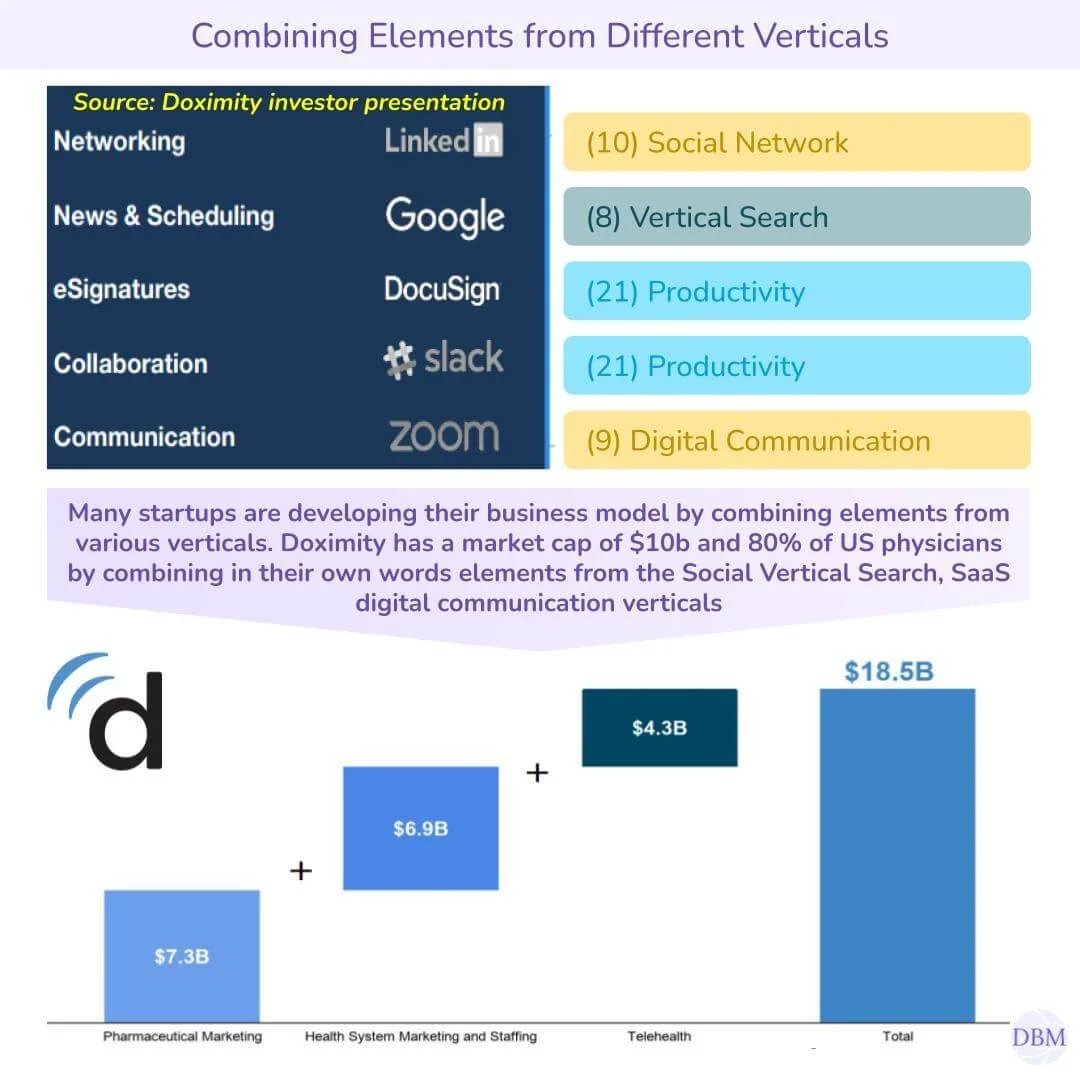

Combining ideas from different verticals

Once we know typical tactics across the digital technology verticals, we can start combining them to something new and tailor them to something more specific.

A great example is Doximity. They are based on a platform business model who facilitate interactions between healthcare professionals, patients and pharmaceutical companies:

Telemedicine via a Zoom-like teleconference (patient - practitioner) and DocuSign-like workflows monetised on subscriptions.

Professional network like LinkedIn (professional social network) - for jobs and job ads.

Search features for treatment solutions (Vertical Search) - monetised via ads (taken up by pharma companies to display to doctors).

Through this combined approach they are addressing some very large markets: $4.3b in Telehealth + $6.9b in health system marketing & staffing (jobs) + $7.3b in pharmaceutical marketing.

With 80% of US medical practitioners on their app, Doximity has a very lucrative customer segment and good prospects to monetise on these markets.

Key insight

Trying to beat the most dominating company in a vertical, like Google or Meta, is probably not the most feasible approach. However, combining ideas from different verticals to something new to capture specific segments and markets is a more promising approach. It is also the approach that many inspiring companies are choosing these days.

Learning from the most successful Digital business models

While trying to beat the largest companies may not be the best starting point, it is a great idea to understand their winning business models.

Looking at the largest digital business models by market cap shows:

#1 Apple: the dominant player in the Hardware / Software Technology Platform vertical who can command premium pricing on their phones due to the combination of a vast ecosystem of largely 3rd party apps, the phone form factors and their brand.

#2 Microsoft: is the largest player in the Software-as-a-Service vertical with their M365 bundle (suite of office productivity software) and other business units. Microsoft’s key segments are in the professional use of office tools (enterprise and education).

#3 Alphabet/Google: their platform business model dominates the Search vertical and monetises via their digital advertising platform that reaches into millions of websites via tracking code and ad display properties.

#4 Amazon: the dominant player in (pure) eCommerce with a mind-boggling fulfilment and delivery network delivering goods faster and cheaper than others.

#5 Meta: leveraging a powerful combination of direct and indirect network effects via their Digital Communication tools (WhatsApp, Messenger) and Social Media tools (Facebook, Instagram), they have built one of the most powerful platform business models and advertising platforms.

Summary

Nobody said learning about multi-billion and trillion-dollar companies is easy. But I hope this article and our digital business model fundamentals series gave a great starting point.

Key insight: The best way to learn about digital business models is:

Learn the underlying concepts underpinning digital business models.

Learn the business model elements: at an aggregate level for digital technology and then across all its verticals to gain breadth.

Learn about the key verticals & subverticals to gain breadth so that you can draw on ideas and knowledge from different verticals (and/or improve on them).

Learn about the most successful business models in each vertical in more detail to gain depth (by combining them with the business model elements and the concepts learned in steps 1 & 2).

The principles and framework outlined in this and the linked free articles constitute the design principles of our flagship course. The course will explain at a significantly deeper level of detail.