The Complete Guide to the Revolutionary Platform Biz Model

What do Google, Amazon Marketplace, YouTube, Booking.com, Spotify, Kindle, Airbnb, Uber, PayPal, Android, App Stores, the Apple iPhone ecosystem have in common apart from the fact that they are some of the fastest-growing businesses of the last 20 years?

They are all based on the platform business model!

The platform business model initiates and manages direct interactions between different types of participants- typically a supply and a demand side - of the platform. It does so by reducing search and transaction costs compared to traditional business models and minimises the risks of these participants interacting directly with each other. A key economic concept leveraged by platform business models is that of indirect network effects.

The success of these envied companies has made the platform business model one of the most sought-after business models. The platform business model is a great opportunity for startups as well as established companies.

For startups, it poses the opportunity to capture a share of established markets and grow large fast.

But established companies too can use it with vast success: Apple is the best example. They were a floundering company for a long time who were teetering at the brink of bankruptcy at times. The initial signs of their turnaround appeared with the great success of the iPod, followed a few years later by the iPhone. A considerable portion of the success of these products is based on the platform business model.

The Platform Business Model

These are all the elements of the platform business model you will learn about today.

What is the platform business model?

Let’s start with what the platform business model is and what it’s not.

The term “platform business” is a bit unfortunate in that it may suggest all technology platforms make use of the platform business model.

This is often not the case.

Take Amazon Web Services (AWS): it is a highly sophisticated technology platform that many would assume is platform business. But it does not run a platform business model. AWS runs a platform-as-a-service (PaaS) business model. At its core it is a linear business model, using subscription and pay-per-use pricing models to monetise.

Equally, Software-as-a-Service (SaaS) is also not a platform business model.

We use the terms “platform business model,” “platform business” and “platform” interchangeably. Some economists also call them multi-sided platforms (MSP).

Platform business model (=multi-sided platforms)

A succinct definition of the term comes from Professor Andrei Hagiu:

“Multi-sided platforms (MSPs) are technologies, products or services that create value primarily by enabling direct interactions between two or more customer or participant groups.”

Professor Andrei Hagiu

But what are participant groups?

Well, it depends on the platform. In most cases, we can distinguish between a supply and a demand side.

Supply side: sellers, content creators, hotels, service providers, hosts, drivers, educators, medical practitioners, etc

Demand side: buyers, (content) consumers, viewers/listeners, guests, service seekers, riders, students, patients, etc

Examples of the Platform Business Model are Google, Amazon Marketplace, YouTube, Booking.com, Spotify, Kindle, Airbnb, Uber, PayPal, Android, App Stores, the Apple iPhone ecosystem.

Examples of the platform business model and the different participant types using them

Creating and capturing value through the interactions between different participant types is one key characteristic of platform business models.

This is one of the important characteristics that we will elaborate on in this article.

Flow of value creation

One can distinguish business models in a number of ways. Looking from the flow of value creation we can distinguish pretty much all digital business models into the following two types of business models:

Linear business models

Platform business models

Before we fully focus on the platform business model, let’s take a moment to briefly characterise the linear business model as well.

Linear business model

The linear business model has fuelled basically all large firms since the industrial revolution. And linear business models have remained relevant in the digital technology space.

The most notable type of technology players using the linear business model are

A majority of (mostly simple) apps

Linear business models don’t create value for the demand side through a different participant side.

In linear business models most of the value for the demand side is created by the business itself. It typically sources inputs from suppliers, adds value through the processing of inputs and then sells it at a margin. The value is also typically delivered by the business.

In platform business models, value is often created and/or delivered to a considerable degree by one of the participant types of the platform - often the supply side. We have seen this in the examples in the table above.

Types & examples of platform businesses

Platform business models have made their way into many digital technology verticals.

Digital technology business verticals:

eCommerce

Online Travel, Dining, Events & Experiences

Asset Sharing and Service Platforms

Search & Vertical Search (incl Market Intelligence Sites)

Social and Communication platforms

Content & Media Businesses

Education Technology

Health Technology

Financial Technology

Hardware & Software Technology Platforms

Software-as-a-Service (linear business model only)

Platform business models are underpinning the success of some of the biggest companies within these verticals. SaaS is the exception and based on the linear business model.

Value creation and value capture

The core of every business model is to create value and to capture value.

Value creation is how the business adds value to its customers. Value capture is concerned with how it makes money from value creation.

The interesting thing about platform business models is that they are actually:

not manufacturing the products that get sold through them, e.g., Amazon Marketplace does not buy any of the products as inventory that get sold on their pages.

not creating the content that gets consumed through them, e.g., Google does not create the websites that people search for on Google. Kindle, YouTube or Udemy do not create the content that gets consumed on their platforms.

and not providing the service that gets taken up, e.g., Uber does not own any taxis. Airbnb does not own any of the homes that get rented through them and TaskRabbit does not employ any of the service providers (“Rabbits”). Service providing workers are typically independent contractors with no guaranteed hours or minimum pay/shifts or other entitlement.

What they do: Platforms provide the services of enabling interactions and transactions among participants.

Our Flagship Course

Get our Flagship Course where you will learn >10x more about the platform business model than in this article.

Economic value-add

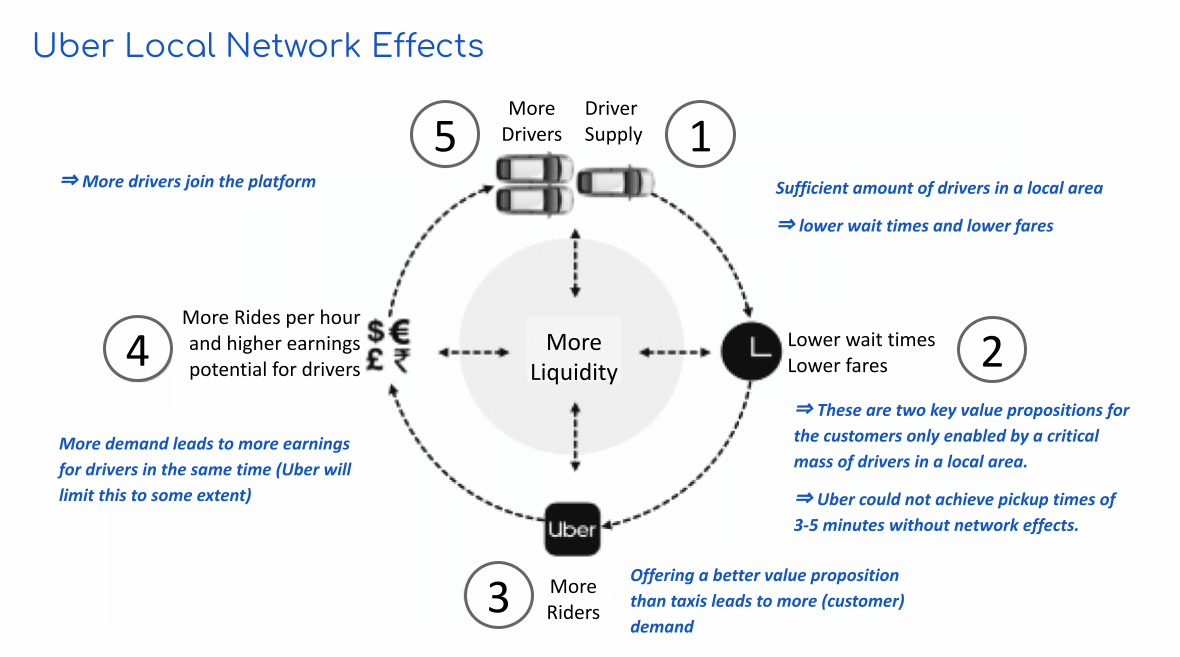

For a business model to work it needs to add value to the participants on their platform. Let’s take a look at Uber as one example. They are a digital platform using tangible assets to deliver value.

One of the key economic benefits to the demand side are cost savings compared to taxis while also providing acceptable income to drivers. The question is where these cost savings come from. In the end, taxi companies have been trying to optimise their cost structure for decades. So, how come that Uber can provide generally cheaper rides than taxis?

Here are some of the key mechanisms by which Uber manages to do so:

Uber helps drivers to unlock already paid-for value in the form of non-usage related depreciation cost. About three-quarters of Uber drivers are part-time drivers using their private car (that they already owned). According to economic statistics, US private cars are low on utilisation:

The average US private is utilised only 5% of the time (72 mins/day) and parked 95% of the day.

And yet it comes at an average cost of ownership per year of $8,558 ($23 / day).

If we were to focus on part-time drivers only, we could say that Uber helps them to unlock value from an asset that they already paid-for and that at least would partially depreciate from a financial perspective even if not used for income generation on Uber. This mechanism works only partially for full-time drivers to the extent that they get private use out of the asset.

Uber lowers unit operating cost through lower idle times compared to taxis. Operating cost for fuel, driver’s pay, servicing cost and other costs accrue in between rides, irrespective if there is a paying customer or not. Even if a taxi drives empty, these costs get incurred and paid-for by the demand side. Uber’s back-to-back ride algorithm gives Uber drivers the opportunity to reduce such wasted costs. One way Uber achieves this is through data and Artificial Intelligence (AI) algorithms.

These two ways of adding economic value can be considered relatively clear.

More complex are the following two because they are a form of redistribution:

Uber saves on regulatory costs that taxis have to pay for in the form of taxi medallions or plates. These are transferable permits that can cost upwards of $200,000. They have been found to be of little value to the demand side according to some government commissioned reports. Nevertheless, if the proceeds are used to fund public transport works, then one can see at least some public benefits. By avoiding these costs, the public purse is rightly or wrongly deprived of such funds.

Other factors: We know that Uber contributes little to worker entitlements. Traditional entitlements include things like safety training, occupational health & safety measures, work cover, job training / licensing, health insurance, sick leave, annual leave, retirement saving contributions and more.

The latter two types of savings benefit Uber users (i.e., the demand side). But they are either paid for by the supply side or saved on contributions to the wider public compared to incumbent competitors. Hence, they are a form of redistribution.

In addition, Uber helps the demand side by saving time including in the search, the exact pick-up and drop-off point, etc. We will see that platforms always provide additional incentives for the demand side beyond financial ones. Economists have developed methods to quantify time savings in financial terms. Hence, to some extent, these can also be added to the economic value-adds.

This example shows some of the mechanisms by which platforms create economic value:

Utilisation of existing assets or skills;

Higher efficiency (often based on the combination of data and AI);

Savings on regulations (some may be outdated, some not);

Savings on worker (supply side) entitlements;

Time, cost and other savings for the demand side.

Some of these are genuine ways, such as increased efficiency. Others are redistributions to the demand side from other sources.

Looking across various platforms we will often find similar sources of economic value-add.

Uber's economic value methods are a crucial ingredient to their revenue model in that they help to reduce the driver's (and thus Uber's) cost base compared to taxis.

Free Downloads

Key characteristics of platform business models

Every business model and industry has its own set of important business management concepts and so does the platform business model.

These are often complementary to the traditional management concepts. The valued reader remains encouraged to always continue educating themselves about business management.

The key characteristic & core concepts of the platform business model are:

The best Apps are not just Apps

They are the front-end to a winning business model…

Study Digital Biz Models to succeed!

(Direct &) Indirect network effects

The creation of network effects and leveraging them for the creation & delivery of value is one of the most fundamental differences of the platform business model compared with traditional business models.

Network effects describe the phenomenon of users getting more value from a product or a service as the number of users increases.

On a high level, two types of network effects can be distinguished: direct network effects and indirect network effects.

Direct network effects are long known from the traditional telephone and other products:

If only a few people in one’s circle owned a phone, then it would be of low value for a user to own a phone. The same holds true for having an SMS service and many other communication technologies.

As the number of users increases so does the value of the network for each individual user without the business adding any new features to the product.

This type of network effect is essential for communication services and social media platforms among others.

Direct network effects, also called same-side network effects, are the effects of members of one participant type on each other.

And then there are Indirect network effects. These are crucial in the context of platform business models.

Indirect network effects are effects of the members of one participant type on the members of other types of participants on the platform.

Take Uber: drivers are one participant type and riders are a different participant type. Thus, they are on different sides of the multi-sided platform (or simply platform).

Uber would create very little value for a rider if there were only a few drivers. Waiting times would be frustratingly long. Equally, for drivers, the platform would have little value without a sufficient number of riders. Idle times for drivers would diminish hourly wages.

Indirect network effects are also called cross-side network effects.

Platforms that enable and leverage Indirect network effects are also called multi-sided platforms or multi-sided networks.

The value of the network, hence the platform, increases with the number of cross-side participants and participation.

With that said we come to the following definition:

Network effects are the effects that incremental participants (and participation) have on the value of the network to other participants.

The platform then is at the centre of all these effects.

The design and operations of the platform creates these network effects which the platform needs to manage carefully on an ongoing basis because they are crucial for the value creation and delivery of the platform to its participants.

With that they are also crucial for the growth of the platform which - when done right - creates a virtuous cycle of value creation, delivery and further growth.

⇒ Indirect or cross-side network effects are one of the most crucial characteristics of the platform business model.

Positive and negative network effects

Both direct and indirect network effects can be positive or negative.

Positive network effects are value- and growth-enhancing

Negative network effects are value- and growth-diminishing

Externalising internal cost

Another important characteristic of platform business models is that of externalising what comparable traditional business models bear as internal cost.

Basically, all platform business models will move as many costs as possible to their supply or demand side but they also provide incentives and value propositions for them to accept these.

Let’s look at a few examples of this important idea:

Take online travel agencies (or OTAs) like Booking.com or Expedia:

These platforms save their users the time of going to a brick-and-mortar travel agency. But users have to spend their own time figuring out all the details of a booking. In a traditional travel agency, staff will do at least some of this, hence have internal cost. Thus, online travel agencies externalise costs from the platform to the user. With this, online travel agencies operate at a lower unit cost than traditional travel agencies on this element who have to pay actual staff wages. However, OTAs need to achieve a certain scale for this effect to kick in because there are considerable upfront costs in building the respective IT infrastructure, algorithms, etc.

This is an example of moving traditionally internal costs to the demand side.

Fascinatingly, this often comes with more personalisation because the user will have a far more tailored trip than one could get in a traditional travel agency. Even platforms like Expedia who had started with package deals are moving to more personalisation.

When done well, the user will remain satisfied throughout the process as they feel their time has been well-spent on getting exactly what they wanted.

Higher personalisation, convenience and lower cost are typical key incentives to be able to move these costs to the user.

Let’s look at another striking example: Think of how Social and Search platforms avoid paying a dime for content creation.

You might wonder what’s the big deal about it. Well, they compete in some respects with various types of content creating businesses, such as newspapers, media companies, traditional magazines or even online magazines, etc.

You can legitimately say that Facebook has 2.5 billion content creators and writers. The New York Times on the other hand has 1,600 writers whose salaries they have to pay for. If Facebook had to pay even one dollar an hour to their content creators, they would be broke in less than a month.

But of course Facebook also has costs. They host all content and reduce the cost of communication for their users to zero. They allow users to reach many friends by just blurting out a thought bubble, photo or video.

Nevertheless, it’s a fascinating example of externalising costs to users compared to linear business models.

Externalising internal cost is typical of platform business models and a very important concept to be aware of, especially when comparing platform business models to competing traditional business models.

Search & Transaction costs

In his work in the 2000s, Professor Andrei Hagiu called search and transaction cost reductions for platform participants the most fundamental principle of platform businesses.

“At the most fundamental level, there are two types of basic functions that [platforms] can perform:

reducing search costs, incurred by the [platform’s] multiple constituents before transacting,

and reducing shared costs, incurred during the transactions themselves.

Any feature or functionality of a [platform] falls into either of these two fundamental types.”

Andrei Hagiu, “Multi-Sided Platforms”, Harvard Business School

For starters, let’s point out that the term cost can refer to many things, not just financial costs.

It can include an individual's time, efforts, skills, knowledge, risk or decision aversion. It, of course, also includes financial costs.

But the term transaction cost dates back to academic work uncovered decades earlier in the context of linear business models.

The concept of transaction cost is considered to be introduced by Nobel Prize winning Law and Economics Professor Ronald Coase in his 1937 work on the theory of the firm.

“Our task is to attempt to discover why a firm emerges at all in a specialised exchange economy. [...]

The main reason why it is profitable to establish a firm would seem to be that there is a cost of using the price mechanism. The most obvious cost of “organising” production through the price mechanism is that of discovering what the relevant prices are. This cost may be reduced but it will not be eliminated by the emergence of specialists who will sell this information. The costs of negotiating and concluding a separate contract for each exchange transaction which takes place on a market must also be taken into account. Again, in certain markets, e.g., produce exchanges, a technique is devised for minimising these contract costs; but they are not eliminated. It is true that contracts are not eliminated when there is a firm but they are greatly reduced.”

Coase, Ronald H. (1937). "The Nature of the Firm".

In this work he asks why firms exist in the first place when exchanges among economic agents could be coordinated through the price system and through markets.

At the most fundamental level, why would individuals subjugate themselves to the employment terms of the firm instead of offering their skills in the open marketplace?

How do larger firms emerge and succeed over smaller firms?

And many other fascinating questions.

Seeking to answer them is an ambitious but worthwhile endeavour.

In the mentioned work from 1937, he lists a number of factors. This includes among others the cost of establishing contracts for each transaction facilitated by open markets.

It argues that firms emerge because they can reduce the costs of such contracts by internalising them into the firm. The term contract in this context stands for one of many other types of transaction costs.

This is one of the several examples that professor Coase lists which later were summarised under the terms of transaction costs.

But why is this even relevant?

Put simply, if internalising transaction cost is an important reason why firms and large firms came into being, then it is pretty relevant if platform business models are doing the opposite, concretely, reducing transaction cost among platform participants.

They thereby undo the very foundations of why, in professor Coase’s view, large firms exist in the first place.

All of a sudden the transaction costs between a demand and supply side are low enough that these participants interact directly with each other through a marketplace created by the platform business.

It is not a perfect market and in many cases may have significant negative externalities. But their very existence is still a scary thought for traditional firms.

This is a pretty fundamental reason why platform business models have come into existence and managed to scale this significantly in a very short timeframe.

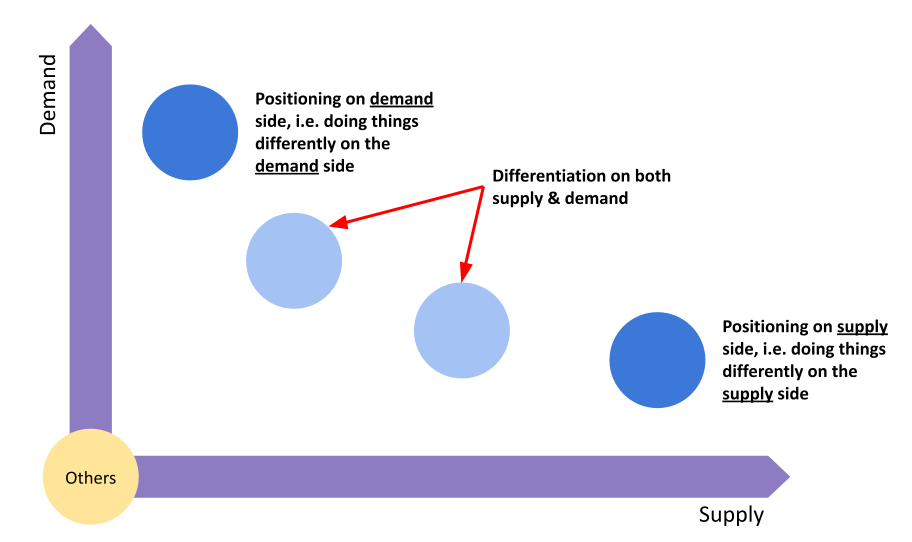

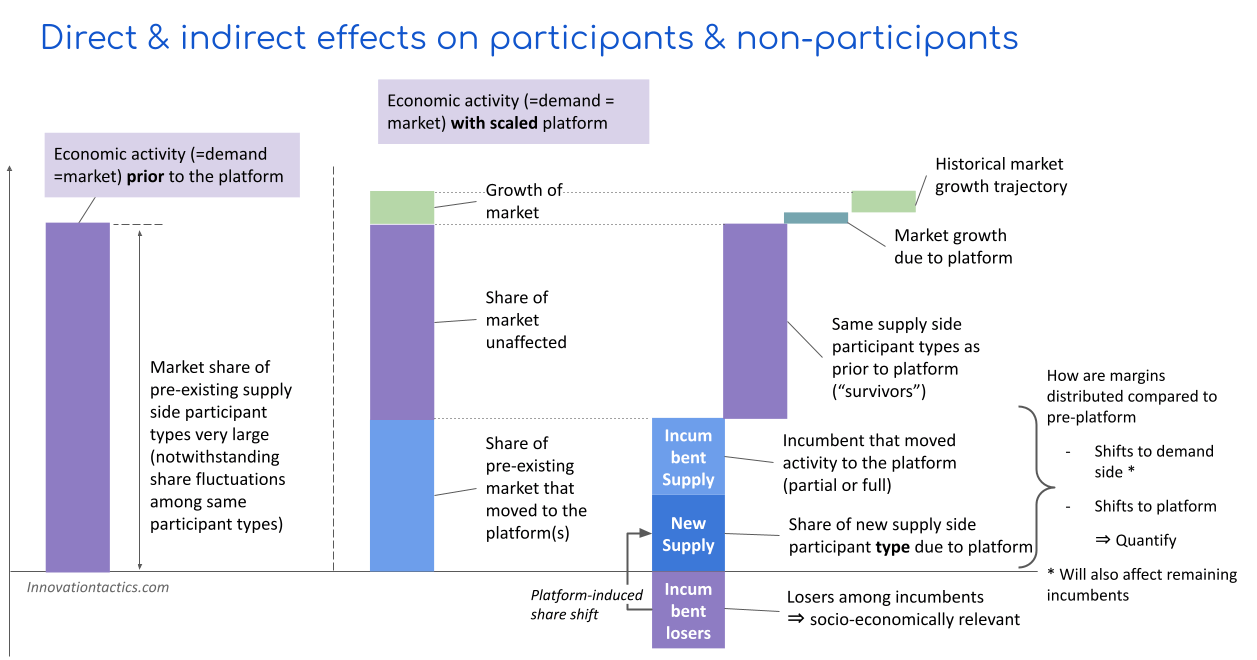

Strategic positioning on the demand-supply spectrum

The concept of strategic positioning was first devised by Professor Michael Porter, one of the foremost scholars of business strategy.It pertains to the question of what and how firms do things differently compared to competitors. Such differentiation can occur on various industry and vertical-specific dimensions.An important dimension of differentiation for platform business models is where they sit on the supply-demand spectrum.

Platform businesses can, for example, be relatively similar pertaining to one participant type and very different when it comes to the other participant type.

Here we can show how platforms can be positioned differently on the demand or supply side relative to others.

The distance to the origin shows the degree of differentiation across each dimension which for any given platform can be small or large. And it can also do so on both dimensions to varying degrees as shown in the diagram.

Let’s assume platform A’s strategic positioning is on the demand side.

Within that two major ways of doing things differently are to:

Create a new channel for existing demand (and move demand there) or to

Create an entirely new participant type on the demand side.

Doing (b) typically includes doing (a). And not surprisingly, (b) is a far more significant form of differentiation than (a).

The same differentiation can then also occur on the supply side. The main point of differentiation may be the creation of (a) a new channel or (b) a new participant type on the supply side.

And then there can be the case of a platform business differentiating themselves in a genuinely new positioning across both dimensions.

As for the latter, we need to be careful not to overuse this category. Given platform businesses connect supply and demand side, a new channel will almost always affect both. But in many cases, the change and differentiation on one of the sides is not as significant. Of course there can be considerable nuances within each category.

Let’s look at some examples for each category to understand it better.

(1a) the creation of a new channel for existing demand

Booking.com in their early days (from 1997 to the mid 2000s) fall into this category.

Hotels already had electronic communication with traditional travel agencies. What’s more, many hotel rooms were already booked through third parties being brick-and-mortar travel agencies. Booking.com must therefore have appeared to many hotels as just another travel agency that happens to take a lower commission (5% commission in the very early days compared to the probably around 15%-20% taken by being brick-and-mortar travel agencies).

From the perspective of the demand side, things were quite a bit different: Compared to booking from the hotel’s page the point of differentiation was to be able to compare prices across many hotels easily, save the time of having to go to the agency, etc. But on the other hand, it must have appeared much more risky to book from a new type of agency that seemed to have no physical presence.

This is why we would categorise the early Booking.com under 1a (as we will elaborate, such positioning changes over time).

(1b) Creating an entirely new participant type on the demand side

Google and Facebook have created new demand side participants in terms of advertisers.

While online advertising like banner ads existed before the existence of these two companies, it was them who have really created an army of small and micro businesses on the demand side of digital advertising many of whom only a few years earlier would not have expected to ever advertise for their business.

This has created millions of new advertisers. The category of advertisers was not new but the segment of millions of smaller digital advertisers certainly is.

The creation of new customer segments very different from those that previously existed and that are large enough to be economically meaningful is a sufficient criteria to fall into this category.

(2a) Create a new channel for existing supply (and move supply there)

Amazon Marketplace’s positioning fell into (2a) of moving existing offline and online sellers to their platform. Amazon Marketplace was not the first one to do this, think of eBay as one example.

But Amazon Marketplace was the first offering a range of new services to their sellers. Over the years, they added Shipping with Amazon and Fulfilment by Amazon, advertising and other services that sellers can take up. This is definitely a new positioning compared to their competitors.

(2b) Create an entirely new participant type on the supply side

Great examples are companies from the Asset & Service sharing vertical: Airbnb, Uber, Fiverr, Taskrabbit.

Uber created armies of drivers with distinctly different characteristics than the previously existing transport companies like taxies. They created an entirely new workforce with considerably different characteristics than taxi drivers.

As one example, taxi drivers are full-time professionals focussed only on this job. In comparison, over 75% of Uber’s supply side participants are part-time drivers who either have another profession or are in-between jobs.

Airbnb, TaskRabbit, Fiverr did pretty much the same. And we can easily add Etsy to this list.

These platforms clearly created a new supply side.

(3) New positioning across both dimensions

Our last category involves a genuinely new positioning across both dimensions, the supply and the demand side.

One early example is Ebay. They started mainly as a consumer-to-consumer platform.

They had to get the demand and the supply side on board with most of the participants not having used online buying or selling before. This was quite a feat.

We don't have any data as to how many of the supply and demand side participants previously engaged in selling to other consumers through traditional methods. It’s not unlikely many of the early cohorts have done so via flea markets, garage sales, classifieds or other traditional methods.

To which extent eBay have created new supply or demand side participants is not entirely clear. But the bigger point is that they have a different positioning on both dimensions of our spectrum than what was there before.

We could subdivide things further within this category. But given this category is probably the smallest of all 5 categories, we will leave this to a case-by-case assessment.

General observations

Let’s close out this discussion with a number of big picture observations.

You have already seen that we don't want to box-in any platform to be exactly within one category. They can sit somewhere in between, say, 2a and 2b.

Strategic positioning is always relative to “others”. For early-day platforms “others” may denote the traditional way of delivering similar value propositions. For later platforms, it can be relative to direct competitors.

Strategic positioning is highly dynamic. Looking at the same company every few years will show different results through either their own innovations and/or how things have evolved around them. To this end, a company’s strategic positioning can and always will change based on not only what they do themselves but also what others do.

With this we also understand why it is of value to be cognizant about one’s strategic positioning. The theory of professor Michael Porter says among others that a differentiated strategic positioning is one of the most important ingredients of a competitive advantage.

Strategic positioning can occur across many dimensions. As for platform business models, the positioning on the supply demand spectrum is - not surprisingly - one of the most significant dimensions.

Getting to critical mass

The next important concept related to platform business models is called critical mass. A useful definition describes:

Critical mass: “The point where the value of the network exceeds the cost of joining for most users. Once a network reaches sufficient size, its network effects start to pull in new users and growth takes off.” [Source: “Modern Monopolies“]

This concept refers to the fact that, while network effects may exist early on, they are too weak to sufficiently help the platform grow. It holds true for direct as well as indirect network effects.

Think again of the telephone. Nobody wants to be the first one to buy it because what should they do with a phone if none of their contacts has one. Where is the point beyond which it makes sense for users to get a phone?

The answer will be different for different people. Some will be happy to join earlier while others will wait until later. Some may buy it for business and commercial purposes and get personal use of it and encourage others to follow.

Beyond a certain point of penetration, those that do not have a phone will risk being left behind and missing out. This phenomenon occurs beyond the critical mass.

The platform's task is to onboard sufficient people through dedicated efforts, so that this task becomes easier and even self-sustained to a considerable degree.

Where the exact point of critical mass is, can be different. For many of those who made it, it is likely well below the point of turning profitable.

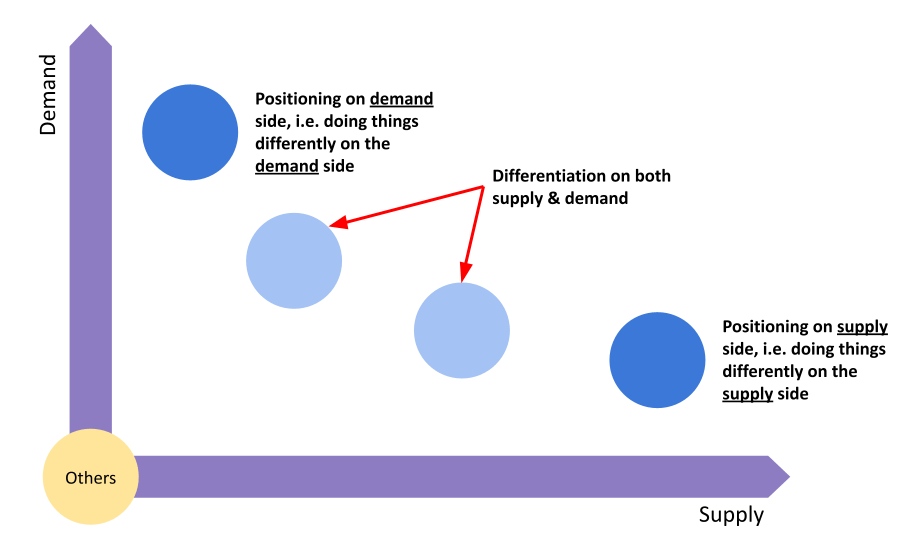

Tactics to getting to critical mass

Tactic 1: Accelerate early supply (with subsidies): One of the most common tactics is to provide some sort of subsidy to the supply side. This could be a sign-up bonus, referral bonuses, higher income guarantees or some other incentive for the supply side.

Related to this is Tactic 2: provide certainty through commitment: Early supply side participants may be hesitant because of entry/start-up costs with uncertain returns (if the platform doesn't scale). The platform could provide surety in various forms.

Tactic 3: Accelerate early demand (with subsidies): The equivalent to tactic 1 can be applied to the demand side. This will often mean heavy discounts or free trial periods. Note that this is different from free-to-use such as search engines or social media which is a permanent feature of the business model. Subsidies can only be temporary.

Tactic 4: Attract high-value users (or celebrities): Not all users are equal. On some platforms high-value users can attract many other users on the same or other side of the platform. Obvious examples are Twitter, Instagram, Telegram and other Social Media but there are many other platforms where super-users can attract many on the demand side (Medium, Yelp, GitHub, Wikipedia, etc).

Tactic 5: Tap/piggy-back onto an existing network: Sometimes platforms manage to successfully partner or leverage other networks or platforms to get to critical mass. Paypal leveraged Ebay in a mutually beneficial partnership to get kick-started.

Tactics 6-8: More fundamental, strategic approaches

Tactics 6-8 are of a more fundamental nature. They may be planned upfront, emerge as a strategic opportunity or be part of a trial.

Tactic 6: start in a niche or micro market, then expand: A very common approach is to focus on a subset of the market in the beginning. In most cases this is unavoidable due to limited resources. The key here is to establish a critical mass of network effects within the chosen niche using the available resources and then expand.

Uber and Airbnb started with a focus on geographic niches. And even therein, Uber used to target airport to CBD routes first.

Tactic 7: Start as a useful single-sided business: Some platforms have emerged from a single-sided tool, app or business and transformed to a platform business by adding another participant type and enabling transactions among different participant types. E,g,, Instagram started as an image editing tool.

Tactic 8: Extend your existing assets: Similar to this, yet somewhat different is to open a business's assets to a platform business model. Amazon started as a linear business model and ten years later opened their fulfilment and delivery infrastructure to 3rd party sellers in the form of Amazon Marketplace.

The Chicken-or-egg challenge

The concept of critical mass is also known as the chicken-or-egg problem when it comes to platform business models. It refers to the fact that you need both participant types to join the platform for it to take off. And given that each participant type is chiefly involved in the value creation for the other side, the question often emerges in which sequence and at which ratio to onboard the participants.

This is a valid and very important question with an iterative answer.

Note that most of the tactics refer to the demand or supply side. But many of them can and will need to be applied to both. In some cases it can make a difference in which sequence this happens. As one example, take that whenever Uber enters a city, they first get the supply side onboard.

Even up to a few years ago critical mass - or the chick-or-egg problem - was this mysterious challenge that some ingenious entrepreneurs solved while the rest of the pack didn't.

But it has become far less mysterious and more of a playbook optimisation challenge. Especially, the first few of the listed tactics are now well-understood as is tactic 6 (starting with a niche).

The main challenges pertain to the concrete decisions within each tactic, in particular the latter, more fundamental tactics.

Combining the tactics

Importantly, one should note that several tactics will almost always be applied at the same time and/or in an overlapping fashion.

The real-world task is to identify the right mix of these tactics and allocate resources, execute and optimise the tactics.

Here is also where the concept of critical mass links back to the strategic positioning on the supply-demand spectrum.

If a platform is positioned on the supply dimension of the supply-demand spectrum, then it's likely that more resources will be spent on that participant type, thus tactics will likely be more poised on that side. This is not a hard-and-fast rule but a likely outcome.

Example Uber

Uber uses a number of the above tactics:

Tactic 1 (accelerate supply side growth)

Tactic 3 (accelerate demand side growth)

Tactic 6 (start with a niche)

Tactic 4 (high-value participants) / tactic 8 (expand existing assets)

Critical thresholds and ratios

In the context of critical mass is the concept of critical thresholds and ratios.

These thresholds, KPIs and metrics can be used to get to critical mass and/or stimulating uptake of the right types of participants.

A few examples are:

Facebook realised a key engagement driver is for new joiners to find 10 connections within the first 14 days. Based on this, Facebook imported contacts from people’s mail, suggested connections and further engaged users with games, media, etc. WhatsApp takes it a step further and it is actually (almost) unavoidable to not share your phone contact list with WhatsApp if one wants to use the App.

Uber realised a high drop-out rate of drivers prior to completing 25 rides. A much-noticed New York Times article described “How Uber Uses Psychological Tricks to Push Its Drivers’ Buttons” to push through this threshold.

OpenTable has found that they need to have at least 25 restaurants to choose from in a given area (suburb-size). This gives people enough choices. Based on this insight, OpenTable changed their overall approach. Instead of diluting their efforts across many cities, they retracted from all cities but four and focussed on getting to 25 per relevant area in those 4 cities.

Medium, Wikipedia, like many other user-generated content platforms, have confirmed the: 1-9-10 Rule: 1% of participants write, 9% edit; 90% read only.

Identifying critical ratios and thresholds will allow to establish measurable KPIs in the quest to get to critical mass and beyond.

Engage!

Getting to critical mass and reaching sufficient positive network effects is a crucial task within the platform business model. But entrepreneurs shall not be under the impression that growth and participation will self-sustain from thereon.

Engagement and the stimulation of demand and participation will remain an ongoing task. A successful business model will be characterised by the fact that the cost of doing so will grow slower than revenue or average revenue per user.

Platforms (like linear digital business models) have developed a long list of tactics to do so. Here are just a few examples.

Platforms can continue using some of the most appropriate tactics shown under the critical mass section even beyond reaching critical mass. The levels, hence associated costs, should get lower as a percentage of revenue.

Loyalty programs are useful to increase customer lifetime value and retention. But they should also stimulate consumption. Booking.com’s Genius program rewards spending on a progressive basis. Hotels.com’s “1 night for free, every 10 nights booked” is another great example. There are countless reward / loyalty programs.

Artificial Intelligence (AI) algorithms are being increasingly used for recommendations, notifications and personalised offers. Home pages of platform business and start pages of Apps are not static anymore. They often feature personalised curations. YouTube will show you a very different start page when you are logged in as will YouTube Music / Spotify displaying favourite songs/videos, recently played and similar songs/videos and related ones.

News feeds on Twitter, Facebook, Instagram, LinkedIn will not show random things but what their algorithms have determined is the most likely content to get you hooked instantaneously and keep going. As users scroll and consume content, ads get placed and thus translate to revenue for the platform.

It remains important to incorporate a sufficient level of stimulation in the business model and the cost structure on an ongoing basis.

Platform Biz Model Revenue Models

The real-world brings about an uncountable amount of revenue models. But attempts are made to categorise them into about one dozen models.

Here we are going to look at the most common types of revenue models used by platform businesses.

One should keep in mind that there are dozens or hundreds of vertical- and business-specific adaptations of the key types of revenue models shown below.

1. Commission model

The most frequently used revenue model for platform business models is a commission model.

This model was used by intermediaries long before digital technologies existed.

And while platform business models are not the same as an intermediary, they make considerable use of commission-type revenue models. Digital tech businesses that run a platform business model often do the same.

Commissions can have a very wide range depending on the technology vertical:

Payment providers like Paypal often charge a below 5% charge when used in the payment process between a business and a customer.

Airbnb takes a commission from hosts for each booking made through its platform of around 15%. For their Events business this is typically 20%.

App Stores take a commission of 30% on each app sale and on subscriptions and in-app purchases through the Epic Game Store takes much less.

Udemy takes around 67% on the sales of online courses.

Comparison to the merchant revenue model

Another revenue model traditionally used by intermediaries is the merchant model. In this model the intermedia purchases goods and sells them onto the end user. They typically source their inputs at a wholesale price and sell them at a marked-up retail price. The difference is their (gross) profit margin.

Amazon is a good example to understand the differences. The standard Amazon being a linear business model uses the merchant revenue model whereas Amazon Marketplace being a platform business model uses the commission revenue model.

2. Subscription model

The subscription model can be combined with many business models and be found across most digital technology verticals.

It is characterised by one transaction involving recurring payments.

This is different from one-off sales which may be followed by replenishment cycles. Replenishment cycles may be more or less regular and, importantly, will bear a higher risk of customers switching to other providers / sellers.

Ths subscription model is more frequent in the linear business model, especially in software-as-a-service.

But it has characteristics that make it attractive for platform business models, in particular the higher predictability of revenue.

We find this revenue model often in the content vertical. It is immediately obvious why this model makes sense for content: content gets stale and needs regular refresh.

3. Advertising

A completely different revenue model from the ones we have seen so far is digital advertising. It is not monetising on the goods or services that the platform provides.

Search engines and social media are the biggest digital advertising providers. Amazon is entering this space big time.

One of the biggest value propositions of digital advertising is that their targeting mechanisms are better than that of traditional advertising channels like print or TV.

This happens through the user data captured and is the reason why usage of such platforms are free-of-charge.

A falsehood is that they are selling the user’s data. This is not what happens and it would be self-defeating.

4. Ancillary revenues

Ancillary revenues may sound like a little bit of extra revenues on the side. But one shouldn’t underestimate them.

All technology companies use them as a growth pillar. In some cases, this may generate 5-10% additional revenues, in other cases it can even be larger.

These types of services are often sold to a captive audience (often the supply side).

This can allow ancillary service revenues to grow very fast, in particular where it dangles the carrot to supply side participants to gain an edge over competitors on the platform.

5. Third party ecosystem-fuelled premium hardware / software sales

The probably best revenue model of all is one is the “third party ecosystem-fuelled premium hardware / software sales”. You haven’t heard this one before because it has been coined by your author.

Maybe not a very practical but a very descriptive name.

It is the model that made Apple the highest valued publicly-traded company and the one that made Microsoft one of the most powerful companies of all time.

And it is the envied revenue model that many consumer electronics companies are trying to leverage.

On the surface, it is the same as a one-off sale revenue model, typically with a replacement cycle. But it’s different.

Products that enable a powerful ecosystem consisting of third party apps, content or interactions can be sold at great margins (many factors need to be done right). But the firm needs to be the owner of the underlying platform. Hardware or software products that fall into this category become more valuable far beyond the direct investments of the company.

In the context of digital tech businesses this model, which is more a business model than a revenue model, deserves a special callout due to its tremendous revenue and profit margin potential.

Platform Impacts

Our focus so far was on the platform business model itself. The last chapter shall elaborate on the various impacts of platform businesses on participants and non-participants.

Economic impacts

Socio-economic impacts

Wider impacts

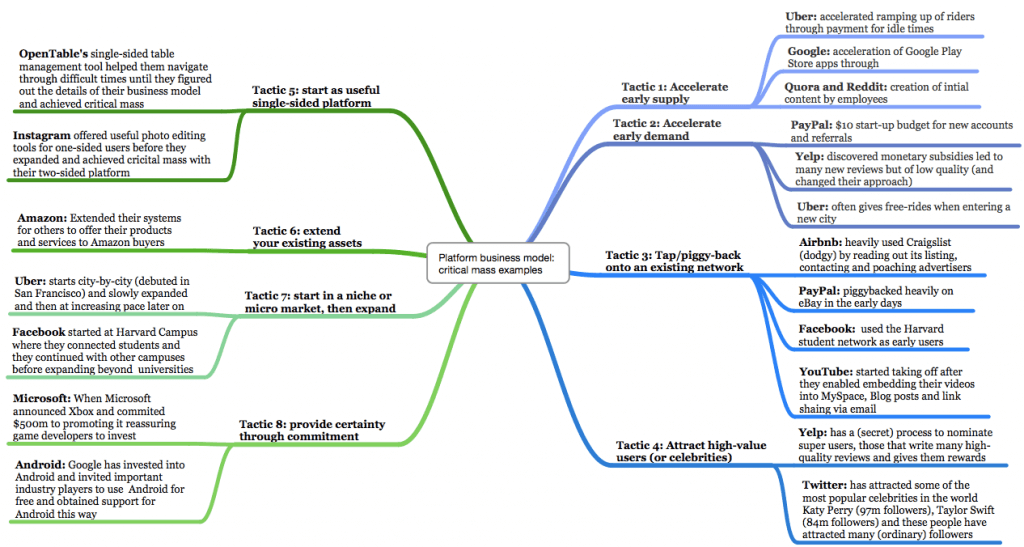

1. Economic impacts

Many observers use traditional methods to model discrete economic benefits which are too broad-based to be very meaningful in our view.

We have developed our own very focussed and powerful set of questions to understand the economic impacts of platforms. We believe these can serve the public discourse better than overly broad-brushed approaches like those found in the typical high-gloss consultancy report commissioned by the platform.

Our recommendation is to seek quantitative answers to the following questions:

What is the source of the economic value-add? Is it newly-generated economic activity or is it pre-existing economic activity that moved to the platform?

In most cases, it will be a mix of both but the crucial question is how much falls into which category

If a majority is pre-existing economic activity that has moved to the platform, then the impacts of the platform will be perceived very differently compared to the case of a platform creating genuinely new economic value-add. And to say it upfront, barring some exceptions, the latter will be a small share.

When pre-existing economic activity or demand moves to a platform, then the question is: which group of economic actors benefited from it previously and who does so with the existence of the platform?

Did it stay with the same supply side participant types or were there market share shifts?

In the latter case, we should seek to understand from whom it went from to whom? Often we will the following types:

“Stay putters”: These are economic agents (businesses or individuals) who existed prior to the platform and have moved some of their business to the platform.

“Winners”: These are economic agents who benefitted from the emergence of a platform.

“Losers”: Then there is the story of the losers. An existing business may have not joined platforms in their industry and lost market share to the “Winners” as a consequence.

These questions are crucially important as answering them will help us to determine the power of the platform over the fate of the participating and not-participating economic agents in their sphere of influence.

Related to this and directly following on from it is the quantification of the impact on revenues. How have the profit margins of the supply side been affected by the platform? In particular, have they lost profit margin and if so to whom

The platform?

The demand side? And

Lastly, how much was it?

These are the economic impacts on participants and the next question is the direct impact of the platform on its competitors and incumbents. How have the direct competitors of platforms fared?

These are important questions. As we understand the answer, we also need to ask what the long-term impacts of these observations are? Long-term impacts can be more profound than what has been experienced so far.

Accompanying our endeavours of trying to understand the purely economic impacts, we also need to keep our eyes open to the wider socio-economic impacts of the platform on participants and non-participants? This should occur in a timely manner and not after the fact. They could turn out to be a lead-indicator for other second- or third-order impacts that are yet to play out and may affect even broader dimensions.

We believe that these fundamental questions can help to understand the economic and wider impacts of platforms.

Policy makers and researchers would be well advised to focus on the right questions first according to a famous quote by one of the geniuses of the last century.

Albert Einstein reportedly was once asked: “If you have one hour to save the world, how would you spend that hour?” He replied, “I would spend 55 minutes defining the problem and then five minutes solving it.”

Hypotheses

In the absence of such quantitative answers, one has to form their own initial hypotheses. Here are the authors working hypotheses based on many years of studying the topic of platform business models:

Platforms participate in the entire market, not just the newly-generated economic impact of the respective market.

Pre-existing economic activity moves to the platform and, in most cases, this will likely exceed the newly generated activity by a lot.

It is certain that non-participants will lose market share as the platform scales and economic activity increasingly moves to the platform.

More supply side participants will feel the pressure to join the platform to avoid loss of market share and revenue.

Shifts of market share occur from non-participants to participants, as well as among those who manage to make the best from the opportunities that the platform brings.

This often leads to the long term effect of the platform growing and gaining further power over the respective market.

In some cases, they displace previous intermediaries.

In some instances, the platform may disintermediate the supply side from their traditional customer base gaining even more power over how demand is shared among supply side participants.

There are likely shifts in profit margins from which the demand side benefits. This also affects non-participants of the platform. In the long-run the platform may be able to increase their commissions as a consequence of their increasing power.

All of these can be effects that policy makers would be interested in.

2. Socio-economic impacts

Apart from the economic impacts, platforms have also led to quite an astounding list of socio-economic impacts that no one would have expected 15 years ago.

The Gig Economy

The term “gig economy” has not been specifically coined to describe impacts of platform business models. But it is also being widely used to describe supply side participation on certain types of platform businesses.

Moreover, it is associated with the socio-economic effects that such participation brings which comes with quite a negative notion.

On the positive side, there is often the chance to start earning quickly. But the negative impacts are more significant, esp for those stuck in such jobs for a long time. Such jobs often come with major shortcomings on worker entitlements compared to traditional jobs. We are all aware of the many discussions relating to Uber, to mention a prominent example.

3. Wider externalities

Economic and socio-economic impacts are not the only wider impacts that platforms can cause. Where one or more platforms play a big role in a vertical, they can lead to a range of effects to the wider public.

One of the most pervasive effects is related to the use of Communication, Social Media and Content & Media platforms for the purposes of misinformation. Intentions can be deliberate or even unconscious.

It is a very complex phenomenon with effects on the social, political, economic, cultural, psychological and educational dimensions that will require ongoing research to understand and manage.

Two of the most affected platforms are Twitter and Facebook. The latter has 30,000 employees to address platform health and reduce platform manipulation. But even the assessment of what is an attempt to manipulate the platform is sometimes a challenging task in itself.

From a business model perspective, this has many impacts such as the cost of managing it. But it can also lead to negative network effects that can hamper the growth or even lead to abandonment of the platform by users.

Negative network effects

Negative impacts and externalities of platform business models to some degree also materialise as negative network effects to the platform. We have described how positive network effects can fuel the growth of the platforms and how negative network effects can do the opposite.

A naive way of thinking about this then would be to assume that platforms have a self-interest of managing these proactively. But doing so can actually be very costly in financial terms and cause a slowdown in growth to a larger degree than not managing them.

As a consequence many impacts don’t get tackled by the platform until absolutely necessary. The fast-growth imperative prevails.

Platforms may endeavour to manage such effects for the purpose of becoming “good citizens”. But this is often a naive way of thinking. Often such changes do not happen until the management of negative effects are legislated. Even the best-meaning platform will hesitate for the fear of competitors gaining an advantage by undercutting standards.

The topic is complex and it is a discourse necessary to be held in the policy, business and public space.

In closing

In closing we can say that the platform business model is not only fascinating, it also has the potential to revolutionise aspects of our economic and social life to a considerable degree.

As with anything of such potential, it also comes with risks.

Our main aim was the description of the business model and we have neither glorified nor condemned the large platforms that have emerged from this business model.

Our hope is that the balanced and factual description of this business model will contribute to the education of a wider range of practitioners that hopefully will be able to add great economic and social value to the lives of many.

Our course will give you profound insights not found elsewhere into the platform business model.