Uber Business Model Canvas

Uber is one of the most prominent digital platform businesses of the last decade.

Uber creates value by enabling and managing transport services provided by a supply side (drivers) and a demand side (riders). And Uber makes money by taking a commission of 25% on each such transaction. Their aggregate take rate (=commission) on Uber Mobility/Rides was between 23.5%-28.9% in Q1’22-Q1’23.

Uber Eats enables transactions between restaurants, drivers and takeaway diners. The revenue model and service charges are more complex in this case and have led to an aggregate take rate of 18.1%-20.6% in the same period.

The Sharing Economy

Uber falls into the sharing economy platforms. These monetise on physical assets owned by the supply side and/or services provided by them. Similar business models are used by transport platforms, urban mobility platforms, vehicle / ride sharing, mobility-as-a-service, food / goods delivery, service sharing, home sharing, things-on-the-go sharing and more. Hence knowledge you gain here will be transferable to many other areas.

Overview

This article is structured in line with the elements of the business model canvas:

you will also get:

Key Partners

Crucial key partners are the participants on the supply side:

Drivers: The drivers are on the supply side of Uber's business model and they can join or leave at a moment’s notice (or multi-home on an ongoing basis with other ride-hailing businesses). It is essential to have a sufficient number of them to be able to provide the customer proposition (timely pick-up at low cost). This is not just a static consideration but also at peak traffic times, when events are on, etc. Indirect network effects (crucial to the business model) do not kick-in without a critical mass of drivers. This fact is best demonstrated by the fact that Uber accelerates supply when they enter a new city. But it's broader than that. While sometimes underappreciated, drivers still have a choice to participate or not. It's a complex topic and it will be interesting to see what - as one example - will happen in the post-pandemic world. Competition over workers is intensifying: the scenarios outlined in this discussion from Aug 2021 have only further intensified as we know now a year one.

Restaurants: Like drivers, restaurants are essential and can join or leave at a moment’s notice. They, too, can multi-home using one of the many competitor meal-delivery offers (including on bike). It’s an ambivalent space due to the high commission that Uber takes. The importance of Uber Eats was highlighted during the covid crisis when Uber Rides basically collapsed while Eats soared alleviating the financial fallout (somewhat). Eats is also one of the biggest growth prospects, yet, this space is highly competed over. DoorDash is spending a lot of money on digital advertising. This can have a considerable impact on Uber. A really fascinating space to observe will be whether DoorDash's more specialised network effects on Dining will succeed or Uber's hybrid ones. Losing (or not being able to achieve potential) on UberEats, could affect the entire business model because it appears that there is more payout for riders on Dining platforms (this would be pretty bad new in a tight labour market),

Restaurants are one of the biggest new opportunities and key partners of Uber

Participants on the demand side are of course in the customer segments category of the biz model canvas

The next important tier of key partners are:

Commercial partners: Uber partners with a multitude of corporates and commercial partners. These types of partnerships differ and have different purposes (e.g. better pick-up/drop-off points, new channels to local markets, enhanced loyalty and more). Many of these partnerships are very important because they are not easy to replicate for some of the smaller competitors with a lesser recognised brand and customer base. These partnerships have grown considerably in their importance and are the area that has changed most in the last 3-4 years (apart from restaurant partner). Here are some examples:

Uber is partnering with hundreds/thousands of malls and attractions to become the preferred ride-share partner of the respective partner and then ease pick-up through defined pick-up points, this includes airports (which has been one of their biggest revenue generators), malls, attractions and more (one example: Universal Studios in LA ).

Many commercial partners for shared rewards and as an additional sales channel, e.g. Starwood Hotels & Resorts, American Airlines, Hilton Hotels, American Express, PayPal and Pepsi.

Loyalty program partners: e.g. collaborating with frequent flyer program provider: such as partnering airlines, tiered rewards programs or here Capital One in the US.

Lobbyists were more important at the earlier stages of the company in that there was an (albeit unlikely) risk of being banned or significantly curtailed. Lobbying work continues on a number of fronts (in particular the employment status of drivers). They can also be crucial for the trajectory of future innovations (in particular autonomous vehicles). We can also see that Uber has backlashes where lobbying is more difficult, esp in Europe.

Cities / communities: Are also very important for various aspects - we will elaborate a bit more in the customer relationship section to keep things more succinct here. But it is listed in the second tier of key partners for a purpose (ahead of tech partners!).

Learn more about key partners in digital business models here.

Other partners:

It is pointless to call out underlying technologies as key partners if all competitors have access to it. Yet, that is what you will find basically everywhere else listed first and as crucial (where you will read that AWS is a key partner of Uber - a saddening case of junk "insights"). Were the underlying technologies not present (maps, app stores, umm.. smartphones), then there would be no Uber (nor any of the competitors). What an insight, hey?

Technology partners: If the same technologies are accessible to all companies, including all of Uber's competitors, it becomes a non-distinguishing factor in terms of competition. A closer look reveals (to no surprise) that distinguishing differences are developed by Uber themselves. Therefore, these are to be listed among the key assets / resources. Two examples are the back-to-back routing algorithms and Uber's work on better pick-up/drop-off points for ExpressPool (since June 2022, this has been rebranded as UberX Share). Nevertheless, there are always some leading-edge technologies that can play an important role in being able to provide better value propositions than competitors. For Uber, this is clearly in the space of AI / algorithms. But here too, insights that come from AI, are always based on questions asked by engineers and this then brings us back to key resources (being Uber's skilled engineers)

R&D Partners: R&D partners are those that collaborate with Uber on longer term business opportunities. One of the most important ones would be those on autonomous vehicles (AVs)

Other partners involved in the non-core value proposition or supporting activities, some examples are Hire car partners (Uber-ready vehicles), insurances, and partner on driver incentive programs (this is a long topic in itself that can be of considerable importance for the full-time drivers)

Investors/venture capitalists were crucial in the early days. Since their IPO, this is less relevant (though there have been post-IPO capital injections). Uber Executive will vehemently deny the lesser importance of investors these days. But the truth is that capital injections into R&D and growth via shares are simply rare. It rather goes into driving the share price (which is beneficial for the Execs but less so for the company's actual growth)

What you should know about Key Partners (and all other aspects of tech biz models):

No aspect of a business model is static and this includes the list of key partners. Granted, a few years ago, Uber's technology partners would have been on the list of their absolute crucial key partners. The standard technologies that are now accessible and copyable by basically any competitor and even relatively new startups are not a distinguishing and competition-deciding factor anymore. Uber is no longer predominantly fighting against Taxis but against other ride-hailing companies.

Uber Business-Model-on-a-Page

We have developed the Business Model on a Page (B-MAP) format to explain value creation in the most concise way.

Focusing on the crucial aspects of the business model, you can gain depth in just 30 minutes.

Included:

Large infographic with value creation and other biz model aspects

15-20 min walkthrough video

What’s more, we have decided to make our B-MAPs super affordable. Our contribution to get your innovation journey kick-started!

Key Activities

Now that Uber has achieved considerable scale, there are three types of key activities: (a) operational excellence, e.g. safety; (b) continued expansion to new countries and cities; and (c) improve existing value propositions and develop entirely new ones.

From a platform business model perspective, most of these activities can also be categorised into reductions of search, transaction / post-transaction costs as well as enhancing positive network effects while reducing negative ones.

Some examples are:

Remove friction (search costs) from all interactions. This includes the many improvements around pick-up points, e.g. location accuracy, spotlight and many other (non-technological) ways

Remove negative experiences (transaction costs), e.g. bad behaviours / safety needs on both sides (rider and driver), e.g. through rating and other measures

Reduce safety risks which often come with the risk of negative coverage and can add to regulatory concerns

Improve the technical lead on the proprietary technologies

Improve the App as well as the involved processes based on user feedback

Keep participants engaged and stimulate ongoing participation. This can include external stimuli, such as providing rewards, promotions, notifications, etc.

Scale driver and customer side (in existing cities) to reduce idle times for drivers and waiting times for riders. This also includes keeping both sides in balance. One (unpopular) way of doing so is surge pricing

Expand and grow into more cities and countries

Continue improving the value proposition, e.g. cheaper rides for regular commuters through Uber Pool / Express Pool (now UberX Share) - see note below

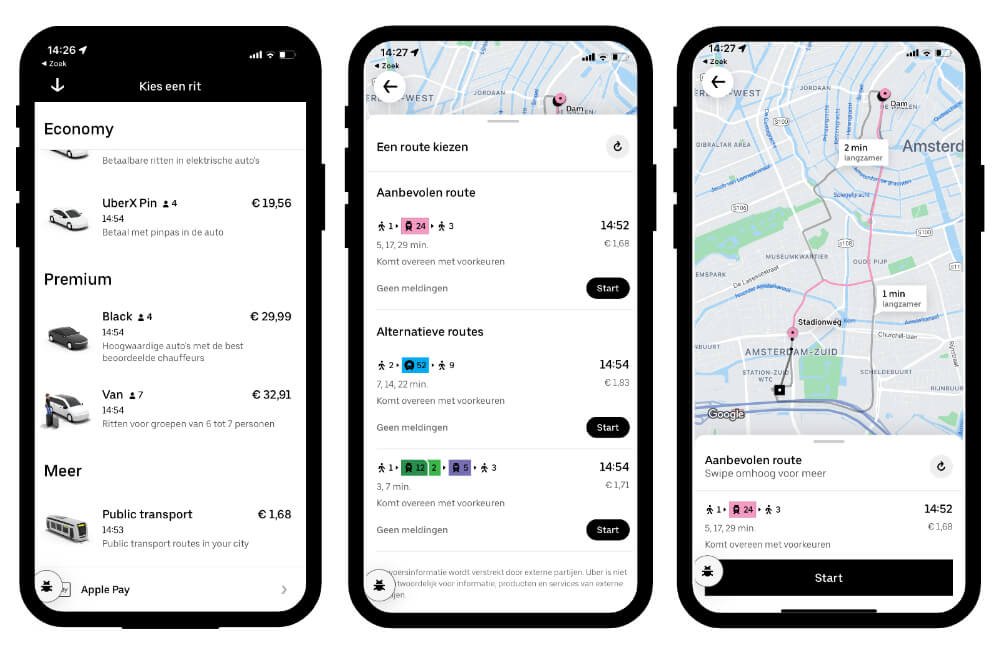

Develop new products: Uber Eats, UberX Share, Uber Transit, Uber Taxi, Uber Freight and many other specific value propositions related to Rides and Eats

Add complementary value propositions (e.g. car financing, new customer segments, etc)

Develop, add to and refine the loyalty / rewards programs

Reduce churn on driver and rider side

Analyse the data to fine-tune everything

Find solutions to long-standing issues, driver dissatisfaction, criticism from cities and communities.

Note that Uber ExpressPool (previously UberPool) was suspended due to the pandemic. It has relaunched in June 2022 under the rebranded name UberX Share (so much better - isn't is?). We believe this is one of the larger opportunities among the current business models (not including long-term opportunities, such as AVs, etc).

Learn more about key activities in digital business models here.

Key Assets & Resources

Network effects between the participants (drivers and riders) are essential and Uber keeps on pointing this out in all investor briefings as their competitive advantage

Algorithms, technologies, analytic capabilities and more

Skilled engineering & other staff, including local staff

Brand: An hugely important asset that helps with the growth and attracting customers as well as drives and restaurants and more

Digital assets:

The user App

The driver App

The Uber Eats App (for users)

The Website: Alexa rank ~1,200th

The tech stack

And more

And a lot more.

Learn more about key assets & resources in digital business models here.

Value Propositions

The value propositions are well-known these days. Notably though, we need to take into account the value propositions for the different types of participants, including the supply side!

Value proposition to riders

Custom ride: the “exact ride” that the user needs (i.e. pick-up and drop-off point without transit on either side)

On-demand from the App, no need to schedule a pre-order (though possible). Uber aims to provide reliable rides in that people don’t have to plan trips ahead of time

The App gives you estimated pick-up, duration and ETA of the ride

Affordability: typically lower prices than a comparable taxi ride (exception: surge pricing); an estimated fare is provided prior to the ride

Ease and convenience: removing friction from all interactions to the extent possible, e.g.

Fast pick-ups (often 3-5 mins) and tracking the driver arriving

Choice in terms of vehicle type (economy, premium, etc)

No need to tell the driver the destination or route

Cashless transactions (exceptions exist)

Rating system that allows for feedback

Safety: rider sees the driver’s name, license plate number, photo, rating before entering the car; sharing of trip with friends/family prior, if desired; real-time tracking during the ride; emergency button and reporting function.

Value proposition to drivers (Uber Rides & Eats)

Some of the value propositions for the drivers (supply side) are:

Income generation and low idle times due to the large amount of active riders

Flexible and predictable work hours as well as self-determined shift durations (at least in theory – the actual incentive system can lead to other behaviours)

Tracking one’s earnings (in real-time) and ability generate immediate earnings and ability to get paid out frequently (esp in the US)

No boss (other than the algorithms and at times challenging guests)

The driver app that helps with navigation, alerts, planning, earnings, etc

Ease of joining: requirements to join can be met by most driver car-owners (mainly: identification, background check, vehicle inspection, 4-door car)

No upfront investment in joining

Ability to earn above average in peak demand (the driver app shows surge areas) – often weekend nights

Driver rewards program: progressive rewards based on work hours, etc

Ability to get customers (passengers) at no cost to the driver (an often forgotten fact)

Insurance coverage through Uber during the ride (drivers still need to show they are insured at other times)

Lesser skills required than taxi drivers (i.e. no need to know most of the streets of the city as you can “let the app lead the way”) but sometimes that is also obvious to the rider

Learn more about the value propositions of digital business models here.

Premium Product

Learn from the best Sharing Economy business models today with the Uber and Airbnb Case Studies. And see what the WeWork hype was about and what we can learn from it.

Covered in unmatched depth:

Business Model

Financials

Economics

Strategy

Download an excerpt & experience the quality you will get. There are 3 case studies in this product (the excerpt is from the Uber Case Study).

Customer Segments

As a multi-sided platform business, Uber will benefit from segmenting both sides: the riders as well as the drivers. Depending on the purpose, Uber likely uses classic market segmentation as well as micro segmentation. Segmentation data can be used for various purposes, including targeting users with more specific/personalised offers, stimulating more frequent use, developing new products, etc.

Traditional segmentation methods

Let’s look at some ideas how Uber might apply traditional segmentation methods to their customers (riders) and their drivers.

Rider segmentation:

Geographic:

Home location, destinations and frequent destinations, user location tracking

Urban / rural

Demographic:

Age / age range

Gender

Life events (e.g. commuting to a new job until own car)

Occupation (e.g. frequent duty travel)

Behavioural:

Loyalty: switchers, soft/hard loyals

Benefits sought: cost efficiency, convenience, etc

User status: Non-user, potential user, first-time user, regular user

Driver segmentation: Here are some categories that drivers could be segmented in. Again, the details of what Uber would use for which purpose remain confidential internal data. Here some plausible examples:

Demographic: age, socio-economic status, family status, residency status / visa type

Geographic: by city, suburb

Geo-demographic: see above example

Behavioural: preferred work hours & patterns

Occupation: whether or not the driver has a(nother) occupation and what type of occupation and education

Pro level: full-time driver with previous driving occupation or other

Offerings served: UberX, Uber Eats, UberX Share, Uber Black, etc; part-time vs full-time (>30h/week), etc

Check here how a consultancy segmented Uber drivers [pdf] (but note that Uber does not have all data listed therein)

Rest assured that Uber uses far more than the above traditional macro segments. And that’s what we are going to look at next.

Other

Here are some specific examples of data analyses that give us an insight of what type of data Uber has and what it could be used for.

Here’s an example of geo-demographic segmentation of Uber drivers in London.

Here’s an example of geo-demographic segmentation of Uber drivers in London.

Uber uses this insight for public relations (though critics could use it for exactly the opposite interpretation) but it can also be well used for targeting prospective drivers [source: Uber, retrieved 2018, link no longer active].

What’s more, it could be used to form a hypothesis. It could go from “In London, nearly a third of driver-partners live in areas where unemployment rates are highest” to something like “In large cities, an ‘overproportional’ share of driver-partners come from areas where unemployment rates are the highest”. It can then be verified for other cities and be used for various purposes.

Take the example of getting new drivers on board. So when Uber sends out the local start-up / scout teams that try to get drivers on board, they can use such insights for digital (i.e. digital ads targeting of respective suburb profiles) as well as direct the local teams to the right neighborhoods.

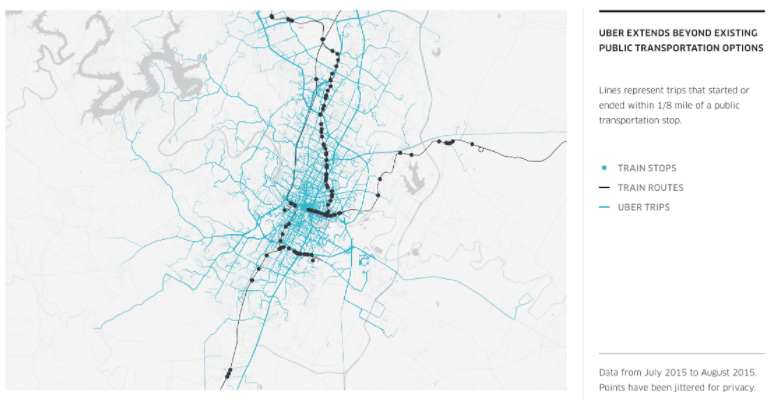

Another example for micro-segmentation is the Austin case study [2015]. It lets Uber conclude that “… people are relying on Uber to connect them to other modes of transportation.” Here, Uber tracks trips by proximity to train stations to conclude that “nearly 60% of trips are one-way, meaning people are relying on Uber to connect them to other modes of transportation.” Again, an interesting insight that can be used for various purposes.

It can be used for behavioural segmentation in that location and/or to form a broader hypothesis that could be verified, refined and applied to many similar cities and situations.

Among other purposes, it could be used for predictive routing of idle drivers in order to have an advantage over taxis who do not possess this info (some experienced drivers may have noticed certain patterns or developed a gut feeling but may not wish to share in order to benefit themselves from it).

As you can see, there are different types of benefits that segmentation / analysis of data can provide to Uber and other platform business models.

Note, how this is different to what you have seen above in the intro, i.e. traditional segmentation approaches. It shows how savvy innovators can use competitor’s habit of sticking with what’s known to gain an advantage.

Learn more about the customer segments of digital business models here.

Channels

Channels for the initial awareness and customer acquisition can be:

Digital advertising channels: With DoorDash advertising aggressively in the locations that they start-up, the big thing is that there is only one #1 spot on Google's search results. And that is a very important place to land on. In addition, it is a paid advertising spot based on auctioning the top-ranking spot. This is another one of the significant changes since our previous major update. In 2022, this channel has become more competed-over. And it's not just that. If DoorDash has entered your city recently, "google" for your favourite dining place. You may find that DoorDash advertises for you to order food from there ... (provided DoorDash is new in your city and your eatery is relevant to them ... )

Word of mouth is often said to be a strong driver, it may follow the typical innovation adoption curve starting with early adopters

Free media coverage based on the novelty factor. Whenever Uber enters a new country or city, it can be sure of tonnes of free coverage. And even negative coverage seems to not be stopping users from joining

Campaigns: free vouchers when Uber enters a new city (e.g. handed out at public transport stations or simply through discounts in the App)

Social media and virality

App stores (iOS, Android) – through high ratings, ads and being feature.

Channels for the daily transactions:

Most transactions are managed through the app, including ordering but also all other aspects, including help, issues, etc

Their webpage allow for sign-up and address the biggest obstacles to joining (the process of joining, how it works, any safety concerns and the collaboration with cities/communities – see above)

Uber’s help pages

Uber uses emails & notifications to engage, stimulate participation; reinvigorate/recover (special offers, reminders, etc)

One of the best visible customer relations channel is Uber’s Facebook page (22m+ likes) with an almost instant response to most direct queries, remarkable (check for yourself)

Tiered customer support channels (via Zendesk)

Automate customer support for high-volume, low severity issues (e.g. forgotten items) to be rapid

Multi-tiered customer support (ability to contact a human) for more severe issues

Salesforce as their CRM software

Learn more about the channels of digital business models here.

Customer Relationships

Customer relationships are very important for a company like Uber that has so much public attention. We are looking at more than their direct customers. The biggest change in recent years is a shift in questioning Uber's right-to-exist to seeing them as part of the new normal and with that the question of legislating and regulating them appropriately.

(1) Relationship to riders

Manage safety risks

Manage bad behaviours (on both sides drivers and passenger) and improve rules continuously

Deal with customer issues in an appropriate manner and timeliness (see “Channels” for more details)

Transparent pricing, e.g. criticism on surge pricing by riders and decreasing hourly income by drivers

Transparency around privacy (a number of repeat coverage over the years on insufficient data privacy, reports of security breach cover-ups)

Portray the desired company image through social and other media

These are relevant to some extent also for drivers.

(2) Relationship to drivers

The relationships to the driver will be mainly defined by what the platform does for them. But it’s not clear cut because of the different types of drivers. Casual drivers with another main job will care about the hourly wage more than anything else. Full-time drivers who use their car predominantly to drive for Uber will look at the wider package of pay and entitlements. The employment status (“partner” vs “employee”) matters for a subset of drivers.

The platform’s ability to generate income (tipping is now available after the previous CEO was strictly against it)

Acceptable hourly wages (an Uber-contracted survey concludes that Uber drivers earn at least as much as taxi drivers, see below for a differing determination by the FTC that concludes only 10% of drivers actually achieve Uber-touted wages). Hourly wages remain a difficult to determine topic. The cost base for those who use their car predominantly for being a rider should be considered to be a very different one to those who use their only sometimes for Uber. A 2018 study (here the actual summary paper, pdf) that came to damning conclusions but was immediately slammed by the CEO and rebutted by Uber’s Chief Economist. I will say more on this later.

Acceptable working conditions and hours. This can pertain to the number of hours that drivers need to work before they start becoming profitable (the concept of contribution margin can be applied well on the drivers’ cost base which means that they need to drive well beyond a break-even point to generate profits).

(3) Cities / communities / general public

Uber has faced massive public and political backlash that has put pressure on local regulators/legislators to look more closely at Uber’s business practices. They are being criticised (among others) for how they treat their own drivers and their impact on taxi jobs.

Here are a few example how Uber manages these discussions:

Uber Movement, a new platform for sharing data with city planning stakeholders, such as transportation planners, elected officials, academics, non-profits *

Referring to an FTC report, 1984 that shows the wasteful economic implications of the taxi medallion system

A more recent FTC report, 2015 pointing out positive effects of Uber on existing taxi value proposition

and more

(4) The wider public

The image in the wider public is also important. It can affect demand as well as the opinion of the legislators. One of the prevailing items is the status of the workers which can drive significant changes to Uber’s business model.

Uber drives their public relations by portraying a positive image. They are stating positive contributions to the communities:

Valuable contributions during the Covid crisis, e.g. free rides for health care workers, free meals via Uber Eats to first responders, support to local restaurants, moving supplies with Uber Freight

Many examples of community support

Pointing out positive impact on the environment, e.g. reducing emissions through UberX Share

Making communities safer, e.g. through reducing driving under the influence

How Uber puts pressure on regulators through their communication campaigns [pdf]

Manage the platform’s image across the media and other relevant channels

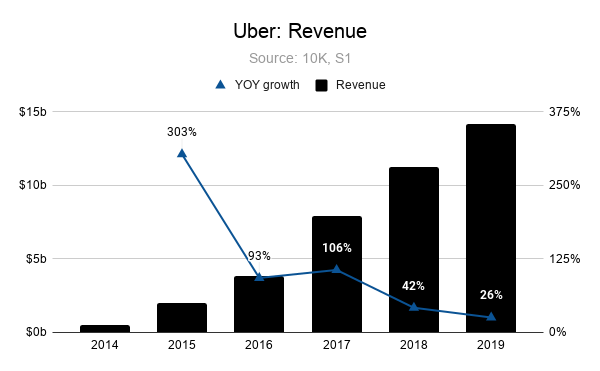

Revenue

The details behind the revenue model

Uber charges a 25% service fee on all rides (Uber Eats is different). An interesting question is how a ride plus a transaction fee is still cheaper than a traditional taxi ride?

Uber’s business model would not work if their rides were not cheaper than a taxi ride, so much so that even with the addition of the Uber commission it still remains somewhat cheaper than the comparable taxi ride.

But how can this be the case?

The answer is that the cost structures are very different. Add to this the differences by country and even on a state, city/municipality level

It is not easy to harmonise cost bases across different driver types. One very important distinction is the one between casual drivers and permanent full-time drivers.

The drivers’ cost base is in Uber’s revenue section because it’s not Uber’s cost base. The drivers’ cost base determines how much of the gross booking value Uber can convert into net adjusted revenue (the gap between gross booking and net adjusted revenue or “take rate”).

Learn more about revenue generation in digital business models here.

Let's look at this is on a qualitative basis.

Comparison to taxis

Qualitative comparison of the driver cost base compared to taxis

Utilising existing assets (depreciation / lease costs):

Most commonly, drivers utilise their own, pre-existing cars

With this, Uber spends no capital costs on these assets, has no associated cost of capital (or WACC) and no ongoing depreciation charges

For the driver, it is an opportunity to get some contribution towards what normally would be an asset parked for 95% of its time. And they still have the personal utility that they bought the car for

Drivers who may have bought a more expensive car for the purpose of driving for Uber would expect to have at least some coverage of the incremental capital costs (principal) and the cost of capital (interest). Though I am not sure if many track this kind of stuff

Drivers will expect coverage of incremental operating and maintenance/servicing cost

There is another benefit for Uber cars in that they most likely achieve higher utilisation than taxis due to Uber’s technology. Driving around until one picks up a customer is simply not as efficient. Having a taxi-central is slightly better but will certainly not close the gap. Add to this, that Uber provides incentives to drivers to adjust supply and demand (and they are working on doing this preemptively)

Ultimately, Uber (and their customers) profit from higher utilisation of an existing asset in this case

It is different if a driver buys or leases a car for the purpose of working for Uber

Uber offers to help prospective drivers to get a car

For a while, they were running their own car leasing business. But this was shut down when it turned out to be far more expensive than they thought (WSJ reports this to have been 18x more expensive). Some will say that this is telling but I will not further comment on it

Uber also got fined by the FTC in 2017 in the context of financing a car for the purposes of generating income which was inflated: “The FTC alleges that Uber claimed on its website that UberX drivers’ annual median income was more than $90,000 in New York and over $74,000 in San Francisco. The FTC alleges, however, that drivers’ annual median income was actually $61,000 in New York and $53,000 in San Francisco.”

These drivers have the “benefit” of real-time costing (all costs are variable). They are likely to calculate their net hourly wage quite differently

On a cost basis comparison, note that many independent taxi drivers also have to finance their own vehicle plus pay (for) license costs (see below) that Uber drivers don’t incur (NYC Uber vehicles now have a TLC fee imposed as well)

Depreciation costs (and resale value / terminal value in accounting terms) are closely linked to the above and also complicated

In summary, in case 1 (using pre-existing cars in addition to personal utility), Uber drivers have a cost advantage to traditional taxi drivers/private chauffeurs. In case 2 (lease to drive), they have a comparable cost base (though there is some subjectivity involved in terms of personal utility of the vehicle in times not used for earning money). Essentially, we can assume lower input costs for Uber on this aspect on aggregate

Operational & maintenance costs:

Both taxis and Uber drivers have much of the same costs, such as petrol, insurance, servicing, cleaning, tyres, general wear and tear, phone. It seems in some countries, taxi drivers have higher insurance costs due to regulation

One could argue that these costs are lower on a revenue generation basis because Uber vehicles will be better utilised (hence don’t drive around empty, yet consuming fuel and generating wear & tear)

Let’s still assume that, by and large, these input costs are quite similar for Uber and taxis

License fees:

In some (or maybe even in many?) countries, there are license fees for operating taxis which go to the government/municipality

In New York City and Chicago, you will find so-called taxi medallions (TLC). Here in Australia, there are the so-called taxi plates

In whichever form they come, some of these schemes are very expensive. In Chicago and Australia in the vicinity of $300,000 (lifetime but they can be sold on). In New York City, the medallions were traded for over $1,000,000 at some stage in 2013. Moreover, they are being traded on respective marketplaces, thus subject to speculation and price volatility

Here in Australia, the taxi plates cost around $300,000. A productivity commission established by the government has found that these schemes offer no benefit to the consumer. The drivers have to work them off for decades to come. In the Australian case, this equated to an average of $2.37 (inflation-adjusted) for the consumer for an 8km trip. This alone is a saving that a regular passenger would notice immediately

The story of taxi medallions is jumbled and saddening for the average taxi driver. For all the bad reporting about Uber, it is remarkable how little attention is placed on the fundamental flaws of the medallion system. Here is a 2018 article stating how the medallion price has crashed from some $1.3m to $160k. Here is a May 2020 article that suggests all existing NYC medallions to be revalued at $250k

In the US, the Fair Trading Commission (FTC) also saw little justification for the medallion scheme (FTC report, 1984)

These are high fees that add no value to the customer (nor to the driver). Uber is free of these artificial barriers to entry that limit supply and drive prices higher. As mentioned, NYC has introduced a TLC fee for for-hire Uber vehicles

Nothing has changed (in Australia) in the 18 years since the productivity report delivered these clear findings

Nothing has changed in the US in the 35 years since the FTC findings. Worse yet, the number of medallions in New York City today is lower than it was in 1937 when the medallions were introduced and this despite increasing population and mobility needs and traffic

Barry Ritholtz (a regular Bloomberg investor-columnist) explains “How the TLC & Medallion Owners Created Uber“ (note, it’s an opinion piece)

Employee entitlements:

Uber engages drivers as contractors. Thus, they do not accrue annual/sick leave, nor do they contribute to social security, pensions or other entitlement

There are some savings here compared to taxi companies. But there are vast differences between countries what taxi drivers are entitled to

This is obviously one of the most contentious aspects of the Uber business model. But it is not black and white as it is often portrayed. Neither is this discussion is not limited to Uber. I have covered this in more detail here. In any case, Uber is trialling affordable sickness, injury, life insurance partnerships for their drivers

I believe that casual drivers will be more interested in maximising short-term cash flow because they see driving for Uber as temporary. Permanent full-time drivers may have a different view. One 2017 article states that only 4% of drivers remain on the platform after one year. I am not sure if this number is correct. I have also read that this number is at 20% (more later)

Certainly, some cost savings here for Uber but it’s not clear how much

Taxes:

There are some interesting points here

Most interestingly, it seems in many countries Uber drivers can claim mileage (i.e. tax deductions for business-related kilometres), here: US and here Australia

This can tip the comparison considerably. Let’s do a high-level calculation. Let’s say one can travel at 20m/h (yes, miles) in city traffic (this should be an ok estimate for many cities). Now, let’s say the driver is utilised 75% of the time. This makes 15m per hour. The standard IRS mileage deduction is $0.52c/m. This calculates to $7.8 per hour. Now, let’s assume the driver net wage per hour is $18/h (this is at the high-end – remember some say it’s closer to $10/h). Even at the high end ($18/h), some 43% of net income comes from tax deductions (I’m sure you can calculate this percentage for the case of $10/h). I.e. taxpayers foot a considerable amount of this

One can see that this is contentious. Sure, taxis get the same tax break. But taxis companies are fully based in the country that they get the tax break in. Thus, the money stays in the local economy (country level view). The criticism will be that a taxpayer in, say Australia, will indirectly pay corporations overseas (the more tax subsidies there are, the less Uber needs to give the driver). Uber will say that the consumer will benefit in terms of lower costs for the ride. It will remain contentious until a productivity commission looks into this

Both Uber drivers and taxis pay GST and some other taxes

From a cost base perspective, taxis and Uber drivers appear to be on a similar footing with the big caveat of mileage needing a more detailed analysis

Economies of scale:

One of the potentially most interesting cost savings comes from Uber’s ability to achieve better prices for their drivers’ input costs.

fuel,

maintenance,

insurance,

phone and

many other things

Uber staggers the benefits depending on the activity of the drivers. Those that drive more, can achieve more savings. There are discount levels from bronze to platinum.

Note that some of the 3rd party discounts are also available to the provider’s retail base, e.g. their loyalty members. In some cases, the Uber-obtained discount may be higher or the driver can join the program without membership fees or incurring other expenses to get the discounts. It is definitely an economic benefit for drivers and a strengthening of Uber’s business model in that scale can lead to lower unit cost.

You can see how complex the matter is. It’s not about solving this for Uber. The message is that as an innovator you should be aware of these kinds of considerations.

The most important insight should be that the revenue is not just the sum of transaction fees. The question will always be if a platform can create enough cumulative value for its participants so that it can capture value for itself.

Learn more about the customer relationships of digital business models here.

Cost Structure

For many online platforms, the biggest cost element are customer acquisition costs (CAC). Up to the release of the IPO document, this was also assumed to be the case for Uber.

However, one rather interesting point that was revealed in the IPO document and subsequent annual report, was the significant cost of revenue. These reports indicate that the biggest elements of it are insurance and payment costs. Cost of revenue was higher than marketing and sales since 2014. It still is possible that cost of customer acquisition is the single biggest driver given that both buckets (cost of revenue and sales and marketing) include many sub-items. But it might not be the case.

Uber’s cost element are (ordered in the highest percent of revenue, 2019):

Cost of revenue (51% of revenue, 2019): including “insurance expenses, credit card processing fees, hosting and co-located data center expenses, mobile device and service expenses.” This cost item went up from 50% in 2018. This would be concerning because it is a direct cost and was coming down over the recent years (in terms of % of revenue) as one should expect. However, the 2019 10-K indicates that the increased inefficiency was caused by the new business areas.

Sales and marketing (33% of revenue): “advertising expenses, expenses related to consumer acquisition and retention, including consumer discounts, promotions, refunds, and credits, Driver referrals, and allocated overhead” (and post-IPO it also includes stock-based compensation to sales and marketing employees)

Research & Development (soared up to 34% of revenue in 2019): slightly higher than sales and marketing (but it was far lower for most of the previous reporting periods). It was largely driven by stock-based compensation for engineering employees, hence likely to go back to previous levels of around 15% over time. R&D costs “consist primarily of compensation expenses for engineering, product development, and design employees, including stock-based compensation, expenses associated with ongoing improvements to, and maintenance of, our platform offerings, and ATG and Other Technology Programs development expenses, as well as allocated overhead.”

General & Admin (23% of revenue in 2019): “General and administrative expenses consist primarily of compensation expenses, including stock-based compensation, for executive management and administrative employees, […] also include legal settlements.”

Depreciation and Amortization (3% of revenue, 2019): It’s this low because most assets (the cars) are owned by the drivers. Once autonomous vehicles come into play this will likely change (though there could be different ownership models). “all depreciation and amortization expenses associated with our property and equipment and acquired intangible assets[ …], and dockless e-bikes […]”

And other costs, including interest expense. Recent bond coupon rates were 7.5% which would be higher without the support of the Fed in the wake of Covid.

Learn more about the cost structures of digital business models here.